Which State Is Best To Open An LLC For Non-U.S. Residents?

Selecting the best state for non-residents of the United States to establish an LLC is a crucial choice. Although several states allow LLC formation, Delaware, Wyoming, Nevada, and New Mexico are the most well-liked options.

With regard to business-friendliness, privacy laws, and tax ramifications, every jurisdiction has unique benefits and drawbacks. Making a decision that aligns with your unique financial and commercial goals requires understanding the subtleties of these phases.

Quick Insight Based On Ranking →

#1 Delaware: Ideal for non-resident LLCs because of its well-established legal framework, robust privacy protections, and favorable tax legislation.

#2 Wyoming: Having strong legal protection and adaptable company rules, Wyoming is renowned as a haven for entities.

#3 New Mexico: Low filing costs, lack of an annual report requirement, and general cost-effectiveness make it appealing.

#4 Nevada: Provides beneficial company taxation and strict privacy laws.

4 Best US States To Open an LLC As a Non-US Resident

#1 Delaware

Because of its many benefits, Delaware is a top option for non-resident LLC owners. The state provides an enticing mix of favorable tax treatment, expedited formation procedures, strong legal protections, and a business-friendly setting.

Legal System:

The state's well-established legal system, which includes the unique Court of Chancery, ensures effective conflict resolution and a stable business climate.

Privacy:

LLC members' identities are protected from public records by the state's strict privacy laws, offering a level of secrecy many business owners value. Delaware also provides strong asset protection, shielding private assets from corporate debt.

Tax Implications:

The tax regulations in Delaware are especially tempting to LLCs that are not residents. One big draw is that enterprises operating outside the state are exempt from state income taxes.

The state's tax attraction is further increased by its low franchise tax and exemption from sales tax on digital items. Creating a Delaware LLC is a reasonably easy and economical process with few documentation requirements and inexpensive yearly fees.

These aspects combine to make Delaware the best jurisdiction for non-resident LLCs looking to establish a strong base for their operations.

#2 Wyoming

Wyoming is a state that was innovative in the use of corporate structures. It remains in the vanguard of business-friendly legislation, having given rise to the LLC. Now that LLCs can operate as Decentralized Autonomous Organizations (DAOs), the state is transforming corporate operations.

Despite its experimental status, Wyoming provides non-US citizens with useful benefits. The state offers low formation and maintenance fees with only a $100 filing charge and a yearly fee of $60 for businesses with less than $250,000 in assets. Moreover, Wyoming has no state income tax, which makes it a desirable choice for maximizing earnings.

For many company owners, privacy is of utmost importance. Wyoming protects LLC managers and members from public records, which provides a certain level of anonymity. A registered agent is necessary, but their ownership information is kept private. Due to its privacy, affordable expenses, and adaptable business climate, Wyoming is a great option for location-independent companies outside the US.

#3 New Mexico

New Mexico offers a compelling alternative for overseas business owners wishing to form an LLC in the US. Privacy is one of its unique qualities; unlike many other states, New Mexico does not require the revelation of manager or member names during LLC formation. For people who value discretion, this privacy layer is a big plus.

Moreover, it is difficult to overlook New Mexico's cheap cost structure. The state unexpectedly does not require yearly report costs and only charges a nominal $50 filing fee for LLC formation. Such cost-effectiveness may be a strong selling point for new and small enterprises. That being said, it's critical to approach New Mexico from a neutral standpoint.

Although the lack of yearly fees is appealing, remember that some payment processors may be less willing to cooperate with LLCs domiciled in New Mexico than those in jurisdictions like Delaware. Furthermore, the "prestige" Delaware is frequently associated with may affect how certain stakeholders view your company.

Ultimately, a thorough assessment of your unique business requirements and priorities should be the foundation for establishing an LLC in New Mexico.

#4 Nevada

Nevada is a particularly good option for non-residents of the US looking to form an LLC. It is a strong challenger because of its business-friendly culture and privacy features.

Taxation:

Because there is no state income tax in Nevada for either individuals or corporations, LLCs are spared a heavy tax burden in this tax-friendly state. Its appeal is further increased by the fact that there is no franchise tax.

Legal System & Establishment:

The adaptable business regulations in Nevada allow for various LLC configurations, including those with just one member. Nevada makes it easy to set up an LLC. Clear instructions are available on the state's web page, and the filing costs are affordable. With just a yearly list of administrators and members needed, annual upkeep is also simple.

Privacy:

Nevada places a high priority on the privacy of business owners by keeping manager and member names out of public records. This dedication to anonymity is further supported by the state's policy of not disclosing information to the IRS.

Together, these aspects make Nevada a desirable choice for non-US citizens wishing to launch and expand their enterprises with the highest possible financial rewards.

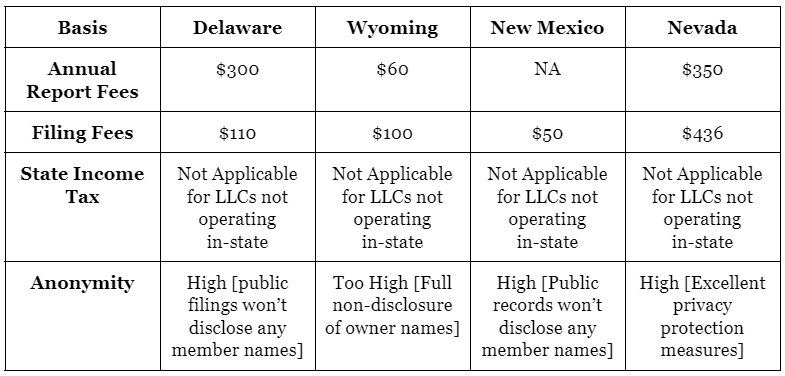

Comparison of The Best US States To Open an LLC As a Non-Resident

Are You a Non-Resident And Wish To Launch Your LLC? Get in touch with SamsCashFlow Agency today

Planning to launch an LLC as a non-resident in the US? SamsCashFlow and their expertise can help you navigate the complexities of US tax laws, enabling you to make smart business choices and optimize your financial stance. Book a call now!

Appendix:

The data below showcases the following:

Basis ; Delaware ; Wyoming ; New Mexico ; Nevada

Annual Report Fees ; $300 ; $60 ; NA ; $350

Filing Fees ; $110 ; $100 ; $50 ; $436

State Income Tax ; Not Applicable for LLCs not operating in-state ; Not Applicable for LLCs not operating in-state ; Not Applicable for LLCs not operating in-state; Not Applicable for LLCs not operating in-state

Anonymity ; High [public filings won’t disclose any member names] ; Too High [Full non-disclosure of owner names] ; High [Public records won’t disclose any member names] ; High [Excellent privacy protection measures]