The 5 Best US Bank Accounts For Non-Residents (Updated 2024)

Many companies and individuals now seek to open a US bank account as a non-resident. The US banking services for foreigners can be overwhelming, especially when understanding the different types of accounts and their requirements.

By offering comprehensive details on the top five US bank accounts designed especially for non-residents, this article seeks to streamline your search. We'll weigh the advantages and features to assist you in making a choice that matches your budget.

5 Best US Bank Accounts For Non-Residents To Know About

1. Chase Total Checking Account

When looking for a US bank account, non-residents often choose Chase Total Checking. Non-residents and foreign nationals with a US address may be able to open an account, though eligibility requirements differ. To open an online account, you usually need to provide your local ID and US SSN; if not, you might need to visit a branch.

Chase Total Checking offers several advantages:

Minimum deposit not required: Start without making a sizable upfront payment.

Free debit card: Take advantage of easy access to your money.

Wide-ranging network: Utilize 4,700 branches and more than 16,000 ATMs.

Digital banking: Use mobile and web devices to easily manage your account.

Extra benefits: Utilize services like Chase First Banking, cardless ATMs, and Zelle.

Remember that there are specific account terms and conditions. Reviewing Chase's standards and weighing your possibilities can help determine which option best suits your financial needs.

2. Revolut Account

Non-US residents can use Revolut as a simple and convenient way to access a US bank account. This Fintech enables account opening to non-US residents aged 18 years and above.

You will need the personal information, identification (passport or US driver’s license), and either a US visa with at least 90 days’ validity from the date of registration or a Social Security Number/Individual Taxpayer Identification Number to register an account.

The strengths of Revolut are its diverse financial tools and the simplicity of the registration process. Among the key advantages are competitive currency exchange rates, low fees for foreign money transfers, and a worldwide debit card for easy international spending.

Users also have early access to their salaries, which offers financial freedom. The latest addition of quick cashback benefits through its Shops function demonstrates Revolut's dedication to improving its offerings in the United States.

3. Wells Fargo Everyday Checking Account

When looking for a US bank account, non-residents frequently use Wells Fargo's Everyday Checking account. Although there is a $10 monthly service charge, this can be avoided by keeping a $500 daily balance, making eligible deposits, or fulfilling certain requirements related to age or military service. With no minimum balance requirements, this account offers flexibility and a contactless debit card for easy transactions.

Significantly, Wells Fargo offers its checking account products, such as the Everyday Checking account, to clients in other countries. Meeting extra standards and supplying particular documents, however, is crucial. In addition to usually needing two kinds of identification, such as confirmation of address, non-US nationals who do not have an SSN or ITIN must present a document issued by the government confirming their nationality or place of residence.

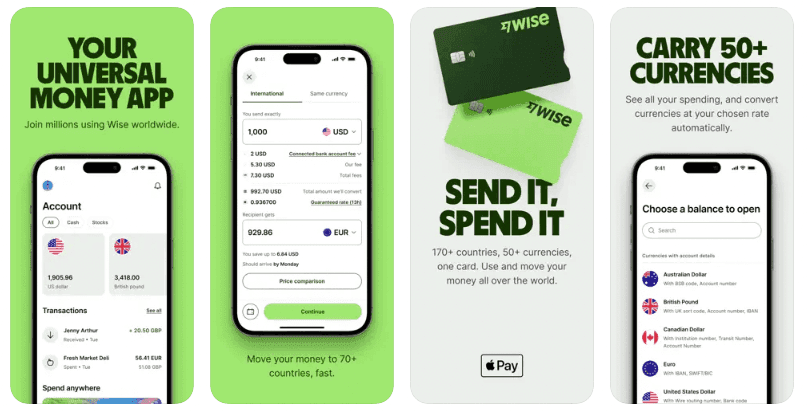

4. Wise Account

Even though it's not a traditional bank, Wise is a useful financial resource for visitors looking for effective US dollar management. With its flexible account features, this cutting-edge money service business (MSB) meets the needs of foreign nationals and travelers alike.

You may keep, transfer, and spend money in various currencies, including US dollars, with Wise. Some of its most notable characteristics are low-cost foreign transfers, mid-market exchange rates, and the ease of using a Wise card for international purchases.

The platform's mobile app and user-friendly design make managing your accounts simple no matter where you are. Consider Wise if you're searching for an affordable, versatile solution to manage your US money.

5. Bank of America Advantage Banking Account

For non-residents looking to open a bank account in the US, Bank of America's Advantage Banking presents a strong argument. This sort of account offers a strong base for managing your money, with essential features designed to meet the demands of a global clientele.

The online and Mobile banking services are strong and enable you to manage your accounts, transfer money, and monitor transactions worldwide. Moreover, this account has low charges and allows fund transfers to 200+ countries in 140+ currencies.

Although Bank of America invites non-residents, it's important to understand that certain limits and requirements exist. In addition to regular identity credentials like a passport and visa, you will require a US address. Depending on your specific situation, you might also need to present additional kinds of identification and verification of a US address.

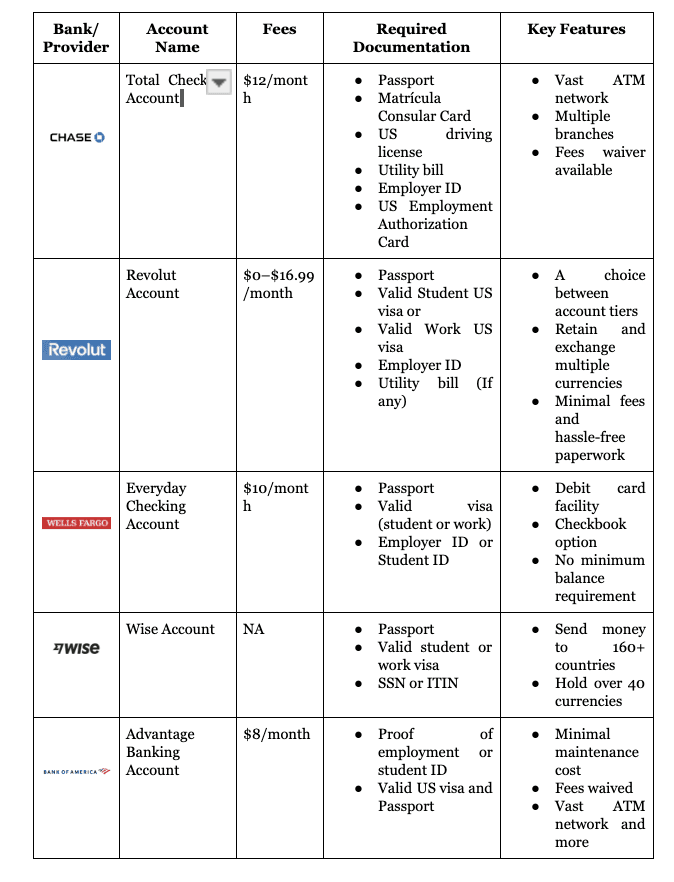

Comparison of Top US Bank Accounts For Non-Residents

Alternative Solutions To Look For

You might not be completely without options if you are denied access to a U.S. bank account for non-residents. Other banking options are available to immigrants. Among them are:

Using an International Bank: Many banks operate internationally and provide accounts in several nations. If a bank from your native country has a presence in the United States, this can be a good option. Even if you live overseas, you might be able to handle all of your financial affairs through one organization.

Using a Correspondent Account: Certain banks have alliances with foreign financial organizations. For non-residents, this arrangement may make opening an account easier. However, the precise terms and circumstances will change based on the participating banks.

A non-resident can open a U.S. bank account with several benefits, such as easy financial transactions, access to necessary banking services, and the chance to establish credit in the country. Nevertheless, the procedure can be intricate and necessitates serious consideration of several variables. To make the most suitable choice for your financial requirements and manage the intricacies of documentation and taxation, think about seeking professional advice.

Need Help Choosing The Right Bank As A Non-Resident? Book a call with SamsCashFlow Agency

Looking for expert assistance to choose the top 5 US Bank accounts as a non-resident? Schedule a call on https://www.samscashflow.com/#book and choose the right bank account while doing business in the US.

Appendix

Provider ; Account Name ; Fees ; Required Documentation ; Key Features

Total Checking Account; $12/month ;

Passport; Matrícula Consular Card; US driving license; Utility bill;Employer ID; US Employment Authorization Card; Vast ATM network; Multiple branches; Fees waiver available

Revolut Account; $0–$16.99/month

Passport; Valid Student US visa or; Valid Work US visa;nEmployer ID; Utility bill (If any); A choice between account tiers; Retain and exchange multiple currencies; Minimal fees and hassle-free paperwork

Everyday Checking Account; $10/month

Passport; Valid visa (student or work); Employer ID or Student ID; Debit card facility; Checkbook option; No minimum balance requirement

Wise Account; NA

Passport; Valid student or work visa; SSN or ITIN; Send money to 160+ countries; Hold over 40 currencies

Advantage Banking Account; $8/month

Proof of employment or student ID; Valid US visa and Passport; Proof of foreign permanent address; Minimal maintenance cost; Fees waived; Vast ATM network and more