Step-By-Step Guide On How To Do Bookkeeping for Chiropractic Clinics for USA Companies

Do you aspire to run a well-administrated chiropractic clinic? In that case, you can’t compromise on proper bookkeeping. It all comes down to keeping your clinic's finances organized and can be the difference between smooth operations or a thousand headaches. Whether someone is opening a chiropractic practice or is looking to sharpen the existing processes, keeping those records precise and knowing one's clinic's financial health is crucial for profitability and compliance with U.S. legal norms.

Here's a step-by-step guide on how you can simplify the bookkeeping process for your chiropractic clinic and be free from all that stress involved in managing finances.

Step 1: Pick the Right Accounting Method and Software

The first step in managing your clinic’s bookkeeping is selecting the right accounting method and software. There are two main methods to choose from: cash basis accounting and accrual accounting.

Cash basis accounting records income when it’s received and expenses when they’re paid. This method is ideal for small clinics with fewer financial transactions.

Accrual accounting records income when it’s earned and expenses when they’re incurred, providing a more detailed picture of your clinic’s finances. This method is suitable for clinics dealing with delayed insurance payments or large volumes of transactions.

Once you've picked your accounting method, choose a reliable accounting software. Popular options include:

QuickBooks: A comprehensive tool for tracking expenses and income and generating financial reports.

Xero: A cloud-based system, great for automating tasks and syncing with bank accounts.

FreshBooks: A user-friendly tool, ideal for clinics with simple invoicing needs.

These platforms can automate several bookkeeping tasks, reducing the margin for error and helping you manage your clinic more efficiently.

Step 2: Record All Your Income and Expenses

Recording every cent that comes into and leaves your clinic is crucial for clear and accurate financial records. This process includes logging all payments, reimbursements, and costs associated with running your chiropractic clinic.

Income Tracking

Ensure that you record all forms of income, including patient fees, insurance payments, and any other services your clinic provides (e.g., selling health products or equipment). Each transaction should be documented, ideally in real time.

Expense Tracking

Track all of your clinic’s expenses, such as:

Medical supplies (e.g., chiropractic tables, instruments)

Employee salaries and benefits

Rent and utilities

Marketing and advertising costs

Continuing education and professional development

By categorizing your expenses, you can easily identify opportunities for cost savings and make accurate tax deductions. Keep receipts and invoices organized for tax season.

Step 3: Oversee Accounts Payable and Accounts Receivable

Managing both accounts receivable (AR) and accounts payable (AP) is crucial to maintaining a healthy cash flow in your chiropractic clinic. Here's how to stay on top of these two key aspects:

Accounts Receivable (AR)

This includes any outstanding payments due to the clinic for services rendered. Effective AR management means:

Tracking invoices sent to patients and insurance companies.

Following up on overdue payments to ensure timely collections.

Applying payments to the correct accounts when they’re received.

Accounts Payable (AP)

On the flip side, you must also manage the clinic’s outgoing payments to vendors, suppliers, and other creditors. Efficient AP management includes:

Ensuring bills for supplies, equipment, rent, and utilities are paid on time.

Keeping track of payment deadlines to avoid late fees or penalties.

Maintaining good relationships with suppliers by paying invoices promptly.

By overseeing both AR and AP closely, you can maintain a positive cash flow, avoid unpaid invoices, and ensure that your clinic runs smoothly.

Step 4: Reconcile Bank Statements

Bank reconciliation is one of the most essential steps in the bookkeeping process. It involves comparing your clinic’s internal financial records with your bank statements to ensure that all transactions match.

Why Reconciliation is Important

It helps identify discrepancies like duplicate payments, missed entries, or bank errors.

It ensures you haven’t overlooked any transactions that affect your clinic’s financial standing.

It protects against fraud by spotting unauthorized withdrawals or incorrect entries.

To reconcile, compare all deposits, withdrawals, and transfers recorded in your books with those listed on your bank statement. Investigate and correct any discrepancies immediately. Ideally, reconciliation should be done at least once a month to maintain accurate financial records.

Step 5: Gather Financial Documents

At the end of each accounting period, you should gather all of your clinic’s financial documents to ensure accurate reporting and audit preparedness. Important documents include:

Invoices for services provided.

Receipts for clinic expenses.

Bank and credit card statements.

Payroll records for your employees.

Organizing these documents is crucial for tax filing and ensuring compliance with U.S. regulations. Consider using cloud-based storage solutions to keep these records secure and accessible.

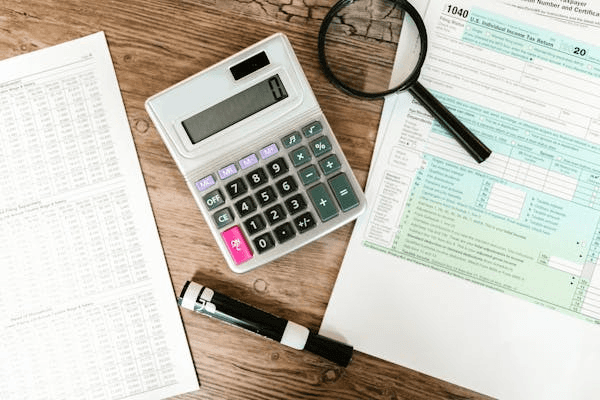

Step 6: Learn About Tax Requirements

Tax compliance is a critical part of bookkeeping for any chiropractic clinic in the USA. Failing to understand or meet tax obligations can lead to hefty fines and penalties. Here are some key tax-related considerations for chiropractic clinics:

Self-employment taxes if you’re a sole practitioner or independent chiropractor.

Employee payroll taxes, including Social Security and Medicare contributions, for clinics with staff.

Sales tax on any health-related products sold in your clinic.

Keep track of deductible expenses such as rent, equipment, and marketing costs. This will reduce your taxable income and help you save on taxes. It’s advisable to consult a tax professional who is familiar with chiropractic clinics to ensure you comply with all federal, state, and local tax laws.

Searching for the Best Bookkeeping Firm For Your Chiropractic Clinic in the US? Call SamsCashFlow Agency!

Having trouble managing your clinic’s finances? Handling the accounting for your chiropractic clinic in the USA can be challenging due to its complexities. However, with expert help from SamsCashFlow, you can stop worrying as they simplify the entire process. Visit https://www.samscashflow.com/#book and schedule a call right away.