Step-by-Step Guide On How To Do Bookkeeping for Divorce Law Firm In The USA

Introduction

In the USA, bookkeeping is a crucial function of any divorce law firm. Maintaining compliance with strict legal and ethical guidelines, handling complex client finances, and making well-informed company decisions depend on accurate financial records.

Precise bookkeeping and accounting services for your divorce law firm mean you won’t have to worry about expenses and finances anymore. You can dedicate your entire focus to property partition, spousal maintenance, and child custody issues.

“According to statistics, a large number of US law firms are dealing with malpractice lawsuits brought about by financial mismanagement. To reduce risks, this calls for the adoption of thorough bookkeeping.

Furthermore, the industry is becoming more aware of the necessity of hiring bookkeeping services since the American Bar Association now mandates accrual accounting and other bookkeeping services for all law firms.”

Although it is best to outsource bookkeeping so you and your divorce law firm can focus on clients and wins, you are always welcome to do DIY bookkeeping. This article teaches.

Understanding Bookkeeping In The US

The fundamental procedure for keeping track of and arranging a legal firm's financial activities is bookkeeping. In essence, bookkeepers maintain financial records by monitoring revenue, costs, and the company's overall financial situation.

This is an essential activity before accounting and is necessary for any type of law practice, but especially for divorce law firms. Precise bookkeeping offers a transparent financial image, empowering legal firms to make knowledgeable choices, pinpoint expense minimization opportunities, and prepare for tax season.

A law firm that lacks trustworthy bookkeeping risks experiencing financial instability, late tax returns, and trouble obtaining loans or investments. Essentially, bookkeeping serves as the foundation for a legal firm's financial administration. It ensures that financial data is correct, easily obtainable, and ready to analyze.

Steps On How To Do Bookkeeping For a Divorce Law Firm

According to Statista, 64% of business owners, whether they run small, medium, or large enterprises, use software or tools for streamlining accounting.

So, if you’re one of these people who wants to learn how to do bookkeeping for their divorce law firm, this section can help. Here are a few effective ways to do bookkeeping for your divorce law firm in the USA:

Step 1: Record All Revenue

Types of Transactions in a Divorce Law Firm To Record For Bookkeeping

Client-Related Transactions:

This includes trust account management, disbursements, expert witnesses, court costs, hourly billing, and retainer fees. All these client-related transactions take place every day in a divorce law firm, making it essential to hire bookkeepers to record the transactions and stay updated.

Operational Transactions:

This includes transactions for essential operational expenditures like insurance premiums, professional fees, marketing expenses, office supplies, utilities, office rent, salaries, and wages. However, these transactions usually take place once a month (exemptions are there too).

Transactions Involving Revenue Generation:

Whenever a divorce law firm generates revenue via fees from its clients or interests from any investment or recovers any bad debt or unrealized fee, it needs to record it in its books to avoid errors in the preparation of the financial statements.

Asset and Liability Management:

Divorce law firms may take loans for expansion or sell their office building or office equipment for cash inflow. No matter what, transactions involving the purchase and sale of assets and liabilities need to be on the firm’s accounting records.

Taxes and Payroll Management:

This includes payroll taxes, employee salaries, and other tax-related transactions. Like any other firm, a divorce law firm also needs to bear these expenses and comply with the tax regulations to avoid any penalty.

Step 2: Managing Expenses and Doing Cost Management

Step 3: Bank Reconciliation

A vital first step in keeping correct financial records for your divorce law practice is bank reconciliation. This is how the procedure is broken down:

Gather Necessary Papers: Gather the related financial records and bank statements.

Analyze The Documents And The Statements: Check that the opening balances and transactions match.

Identify Inconsistencies: Find the corporate or bank mistakes causing the mismatches.

Reconciliation For Differences: Fix bank issues and make any necessary adjustments to company records.

Revise The Cash Amount: In both records, the financial situation is accurately reflected.

Check the Outstanding: Take note of pending checks and deposits in transit.

Verify Charges At The Bank: Check the correctness and validity of the bank charges.

Create Reconciliation Reports: Write thorough reports, providing a process summary.

Get Consent: Verify adherence to company policies and guidelines.

Step 4: Analyzing Financial Statements

Things You Need To Do Bookkeeping For Divorce Law Firm

Precise financial management is essential for divorce law firms. By implementing a well-organized bookkeeping system, you may maintain regulatory compliance, expedite operations, and guarantee accurate financial reporting. The following are essential elements of a successful bookkeeping system for divorce law firms:

Software Selection: For effective handling of intricate financial data, select accounting software designed specifically for law practices.

Chart of Accounts: Make a thorough chart of accounts to classify revenue, costs, and client matters associated with the legal profession.

Financial Regulations: To help employees keep things consistent and establish clear financial procedures and regulations.

Role Assignment: To maximize effectiveness and responsibility, assign distinct roles and responsibilities for bookkeeping duties.

Data Security: Use reliable data backup and storage solutions to safeguard confidential financial information.

Billing and Spending: Create effective systems to monitor billable hours, client spending, and billing.

Client Case Codes: Use client matter codes for precise financial monitoring and case-specific reporting.

Documentation: For openness and auditing, keep thorough records of every financial transaction.

System Review: For continued effectiveness and compliance, regularly evaluate and update your bookkeeping system.

Conclusion

Strong bookkeeping is essential to a divorce law firm's financial stability. You can ensure compliance, maximize operations, and make wise decisions by monitoring revenue, controlling spending, reconciling bank accounts, and analyzing financial documents.

Although it is possible to do bookkeeping yourself, outsourcing this task might provide lawyers more time to focus on their main skills. In the end, strong financial standing enables divorce lawyers to prosper and provide outstanding client care.

Remember that maintaining accurate books is essential to protecting your company's future—it's not just about the numbers.

Appendices:

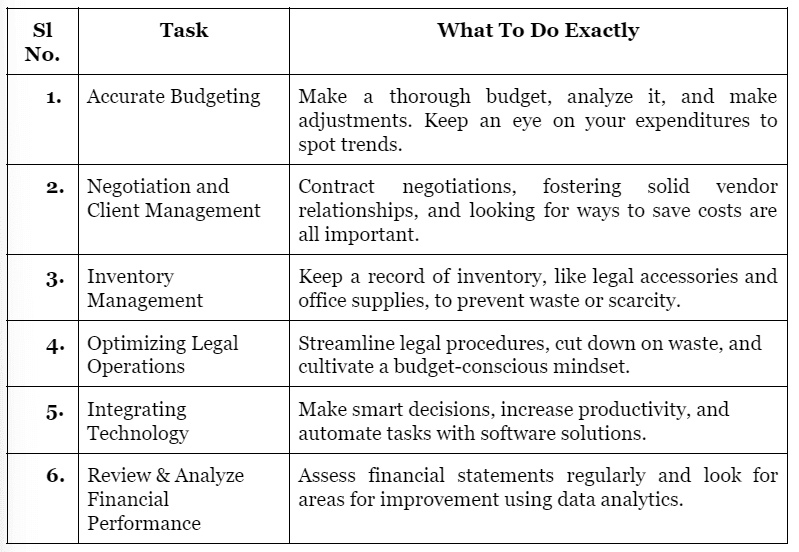

Appendix A

Accurate Budgeting: Make a thorough budget, analyze it, and make adjustments. Keep an eye on your expenditures to spot trends.

Negotiation and Client Management: Contract negotiations, fostering solid vendor relationships, and looking for ways to save costs are all important.

Inventory Management: Keep a record of inventory, like legal accessories and office supplies, to prevent waste or scarcity.

Optimizing Legal Operations: Streamline legal procedures, cut down on waste, and cultivate a budget-conscious mindset.

Integrating Technology: Make smart decisions, increase productivity, and automate tasks with software solutions.

Review & Analyze Financial Performance: Assess financial statements regularly and look for areas for improvement using data analytics.

Risk Management: Create strategies to cut unforeseen expenses and protect the divorce law firm from financial difficulties.

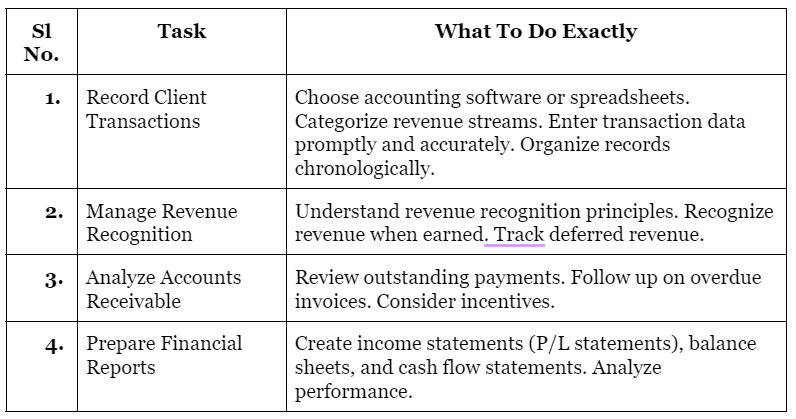

Appendix B

Record Client Transactions: Choose accounting software or spreadsheets. Categorize revenue streams. Enter transaction data promptly and accurately. Organize records chronologically.

Manage Revenue Recognition: Understand revenue recognition principles. Recognize revenue when earned. Track deferred revenue.

Analyze Accounts Receivable: Review outstanding payments. Follow up on overdue invoices. Consider incentives.

Prepare Financial Reports: Create income statements (P/L statements), balance sheets, and cash flow statements. Analyze performance.

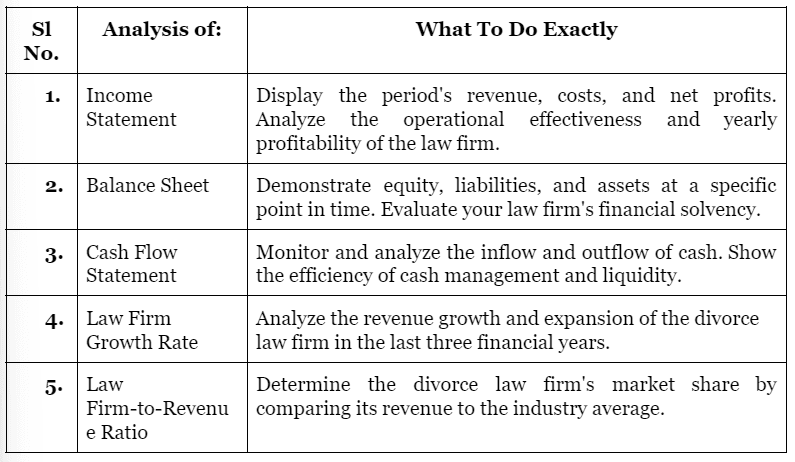

Appendix C

Income Statement: Display the period's revenue, costs, and net profits. Analyze the operational effectiveness and yearly profitability of the law firm.

Balance Sheet: Demonstrate equity, liabilities, and assets at a specific point in time. Evaluate your law firm's financial solvency.

Cash Flow Statement: Monitor and analyze the inflow and outflow of cash. Show the efficiency of cash management and liquidity.

Law Firm Growth Rate: Analyze the revenue growth and expansion of the divorce law firm in the last three financial years.

Law Firm-to-Revenue Ratio: Determine the divorce law firm's market share by comparing its revenue to the industry average.

Book A Call With Our Licensed In-house CPA