Step-By-Step Guide On How To Do Bookkeeping for Medical Clinic For USA Companies

Introduction

Bookkeeping serves as the backbone supporting efficient financial oversight for all medical clinics. Documenting, sorting, and summarizing monetary dealings furnishes accurate financial data essential for compliance, cash flow administration, and informed decision-making.

This extensive guide explores bookkeeping approaches particularly applicable to healthcare establishments in the USA, outlining recommended techniques and country-specific factors.

A Detailed Breakdown of Bookkeeping Protocols for Medical Clinics in the USA

Let’s begin with an analysis of how bookkeeping is implemented at medical clinics in the United States.

Step 1. Choose the Right Accounting Method

Initially, select an accounting method accommodating your clinic's size and circumstances. The two principal options are:

Step 2. Set Up a Chart of Accounts

Additionally, a chart of accounts should be developed to organize revenue and spending categories. This sorting simplifies performance tracking. For instance, a medical clinic's ledger may separate patient charges, insurance reimbursements, supplies, salaries, and rent - providing granular insight into financial flows.

In summary, accounting underpins operational transparency. By choosing wisely from frameworks attuned to the country's healthcare industry, clinics gain control of funds for compliance and informed governance.

Account Type

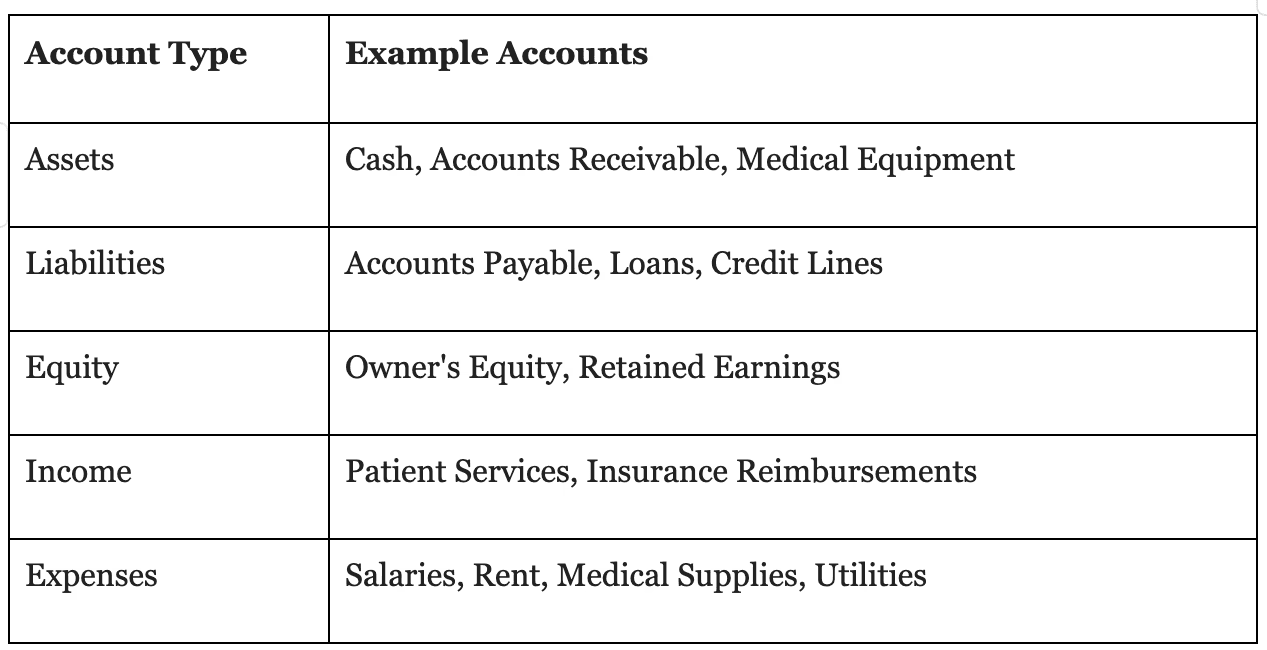

Some common examples include assets, liabilities, and equity. Assets encompass cash holdings, amounts owed to the business from customers, and physical resources like medical equipment. Liabilities capture what the organization owes: unpaid bills to suppliers, loans, or available credit lines. Equity shows the remaining claim owners have after deducting liabilities from assets, including retained profits kept in the business.

Income stems from patient healthcare services provided and insurance reimbursements received. Expenses then deplete the incoming funds through outflows like wages for clinicians and staff, rental costs for the facility, necessary medical supplies, and ongoing utility bills.

Here’s a tabular representation of the account types -

Step 3. Consider Accounting Software

Advanced accounting software takes the hassle out of bookkeeping tasks. Some frontrunners, popular with clinics, offer user-friendly interfaces for invoicing customers, tracking expenses, and generating insightful reports on financial operations. Well-known options incorporate comprehensive features in an online setting, real-time collaboration abilities, and customizable visualizations of spending patterns and revenue streams. Time-saving apps streamline invoicing and outlay monitoring, too.

Step 4. Log Each Day's Transactions

A daily routine of recording all monetary activity guarantees accuracy over time. Keeping receipts from patients and their coverage plans captures cash as it flows in. Expenses likewise require logs, whether payroll obligations to pay workers, materials essential for treatment, or utility costs. Producing invoices promptly ensures billing for rendered services.

Step 5. Oversee Accounts Receivable

Effectively managing amounts owed preserves a steady cash circulation. Speedy invoicing, just post-consultation, encourages prompt payment. Continuous monitoring reveals which invoices remain outstanding versus which have cleared, aided by software-generated delinquency reports. A system for periodically contacting late payers maintains pressure.

Step 6. Reconcile Bank Statements

Monthly reconciliation verifies that financial records and bank statements line up. A side-by-side comparison identifies transactions included in the accounting software with real-world payments and deposits. Any mismatches require investigation to find their root and suitable record adjustment.

Step 7. Compile Financial Statements

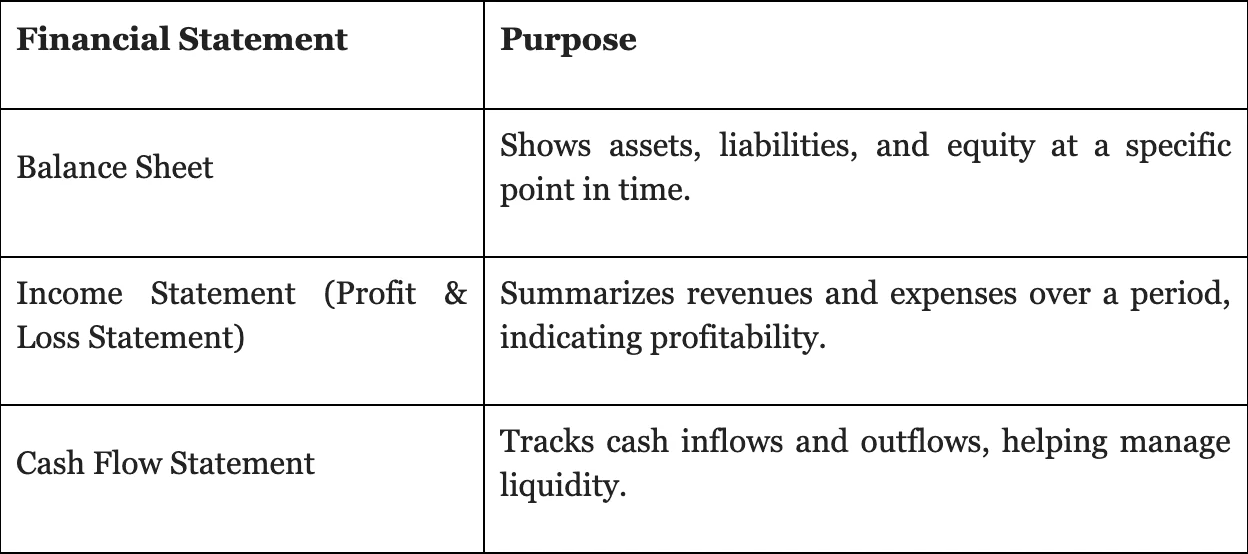

Financial standing offers a picture of your medical clinic's monetary performance. Key statements incorporate:

Step 8. Stay Compliant with Regulations

Medical clinics in the USA must coordinate with different bodies, including HIPAA (Health Insurance Portability and Accountability Act) and the Affordable Care Act (ACA). Keep patient data secure and secret in your financial records. Keep up monetary records for the necessary retention periods as government and state laws ask.

Step 9. Consult with a Professional

Consider counseling with a proficient bookkeeping or accounting firm like the Samscashflow agency, which has expertise in medical practices. They can help guarantee that your accounting practices are consistent and proficient. An expert can help with:

Setting up your accounting system.

Preparing financial statements and tax returns.

Offering strategic financial advice.

Step 10. Review and Adjust Regularly

Consistently surveying your bookkeeping processes and making changes is essential. This could include:

Updating Your Chart of Accounts

Adopting New Technology

Adjusting Financial Strategies

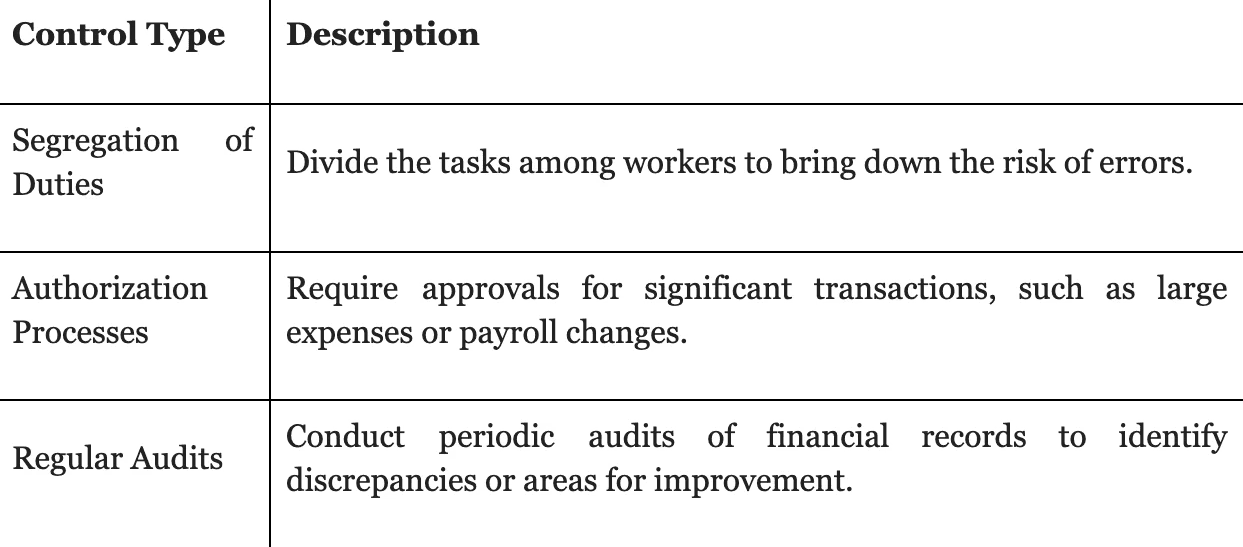

Step 11. Implement Internal Controls

Consider applying the following controls:

Things to Keep in Mind

Isolate Personal and Business Funds: Continually sustain separate bank accounts for private and clinic funds to avoid potential IRS issues.

Stay Neat: Keep all receipts, invoices, and fiscal files arranged. Utilize digital storage alternatives to cut down on paper mess.

Automate Where Apt: Use technology to mechanize invoicing, installment reminders, and cost tracking to spare time and lessen mistakes.

Monitor Cash Circulation: Regularly dissect the cash stream to ensure your clinic can fulfill its financial commitments and avoid potential cash shortages.

Educate Your Crew: Confirm that all teams engaged are trained on your bookkeeping practices to uphold consistency and precision.

Need Help with Bookkeeping for Your Medical Clinic In the USA? Get In Touch With SamsCashFlow!

For professional help overseeing your medical clinic's accounting and bookkeeping needs, call Samscashflow at https://www.samscashflow.com/#book. Their devoted group gives customized solutions to help you stay compliant, organized, and focused on patient care.

Call now to streamline your finances and enhance your clinic's operational proficiency!

Appendices:

Appendix 1

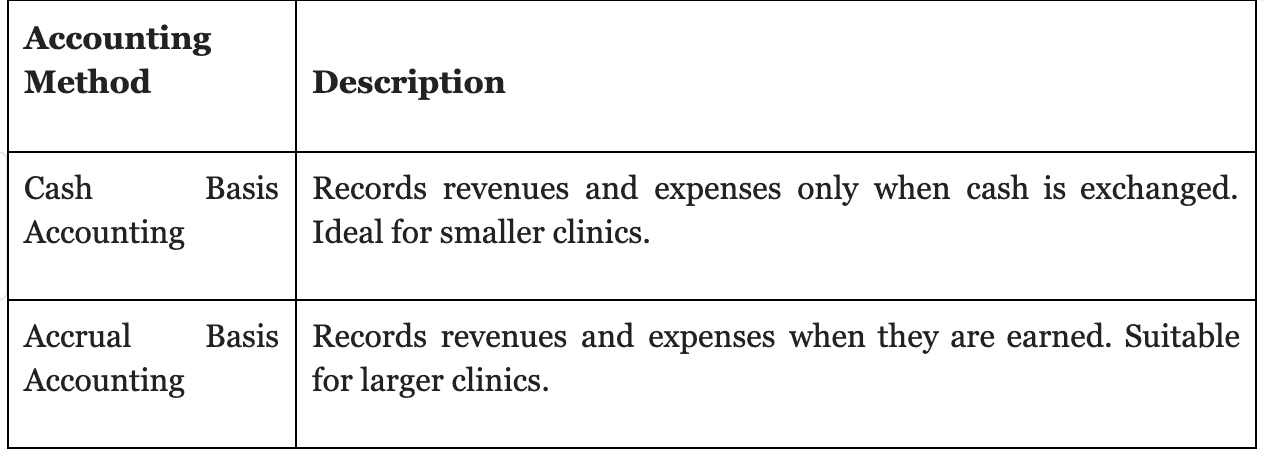

Accounting Method, Description

Cash Basis Accounting; Records revenues and expenses only when cash is exchanged. Ideal for smaller clinics.

Accrual Basis Accounting; Records revenues and expenses when they are earned. Suitable for larger clinics.

Appendix 2

Account Type, Example Accounts

Assets; Cash, Accounts Receivable, Medical Equipment

Liabilities; Accounts Payable, Loans, Credit Lines

Equity; Owner's Equity, Retained Earnings

Income; Patient Services, Insurance Reimbursements

Expenses; Salaries, Rent, Medical Supplies, Utilities

Appendix 3:

Financial Statement, Purpose

Balance Sheet; Shows assets, liabilities, and equity at a specific point in time.

Income Statement (Profit & Loss Statement); Summarizes revenues and expenses over a period, indicating profitability.

Cash Flow Statement; Tracks cash inflows and outflows, helping manage liquidity.

Appendix 4:

Control Type; Description

Segregation of Duties: Divide the tasks among workers to reduce the risk of errors.

Authorization Processes; Require approvals for significant transactions, such as large expenses or payroll changes.

Regular Audits; Conduct periodic audits of financial records to identify discrepancies or areas for improvement.