Step-By-Step Guide On How To Do Bookkeeping for Plumbing Business For USA Companies

Bookkeeping plays a pivotal role in operating a plumbing enterprise in America. Maintaining accurate accounts not only permits following earnings and costs but also facilitates well-informed fiscal choices, guarantees adherence to taxation rules, and ultimately facilitates the expansion and long-term viability of the venture.

Precise bookkeeping simplifies strategic planning and budgeting for upcoming quarters. It is equally important to stay updated with changing regulations to avoid penalties. While bookkeeping demands dedication, making time for it ensures a healthy business with longevity. This guide shall escort you through the fundamental stages to productively oversee bookkeeping for your plumbing company.

Let’s get started.

Step 1: Understand the Basics of Bookkeeping

Before delving into the details regarding recording business finances for a plumbing enterprise, it is imperative to comprehend fundamental principles. Through a double-entry bookkeeping approach, each monetary deal affects no less than two accounts, confirming equilibrium is maintained in the accounting equation. An account roster outlines all ledgers employed by the company to categorize economic transactions, comprising income, costs, resources, liabilities, and equity.

In addition to fundamental documentation like a statement of operations, balance sheet, and cash flow statement, analyzing a plumbing venture's fiscal health involves comprehending variations in job types, materials necessary, and personnel required, along with other factors influencing its performance from one period to the next. The proprietor must discern patterns and respond appropriately to optimally manage this complex yet potentially lucrative line of work.

Step 2: Set Up a Bookkeeping System

With fundamentals understood, selecting an ideal bookkeeping method is crucial. You may do it manually with spreadsheets or invest in accounting software to streamline the process. Popular cloud-based options include -

QuickBooks Online: Well-suited for SMB plumbing companies, particularly for tracking labor costs, inventory of plumbing supplies, and other operational expenses.

FreshBooks: Known for its user-friendliness and focus on service-oriented businesses like plumbing, which involves invoicing clients for parts and labor.

XERO: Provides simplicity and robust features for managing finances, including integration with job scheduling tools and tracking tool purchases and maintenance.

The right system will optimize your bookkeeping while keeping your records organized.

Step 3: Create a Budget

A budget is a financial plan outlining expected income and expenses over a specific period. It is imperative to properly estimate incoming revenue based on past sales figures and current marketplace tendencies.

For a plumbing business, specific expenses to consider include:

Employee Salaries: Plumbers, apprentices, and administrative staff wages.

Plumbing Equipment and Tools: Regular purchases of wrenches, pipe cutters, and other specialized tools.

Training and Certification: Ongoing training and certification for plumbers to keep up with the latest industry standards.

Insurance: Liability insurance to cover potential on-site damages and workers' compensation.

Constantly scrutinizing the budget, contrasting real income against projections, and adjusting appropriately helps stay on course.

Step 4: Track Income and Expenses

Precisely listing income and spending is essential for correct bookkeeping in your plumbing business. Begin by accurately recording each transaction, such as invoices, receipts, and bank statements. Plumbing businesses often deal with multiple income streams, including emergency repair jobs, installation contracts, and maintenance services. Each should be tracked separately.

Key expense categories include:

Materials: Pipes, fittings, sealants, and other consumables.

Vehicle Costs: Fuel, maintenance, and insurance for service vans and trucks.

Overheads: Rent for office space, utilities, and telecommunication services.

Accounting software can mechanically manage this process and lessen the probability of mistakes.

Step 5: Manage Invoicing and Payments

Effective invoicing and payment administration are fundamental for maintaining healthy cash flow in your plumbing business. Start by generating professional invoices using accounting software, confirming they include all necessary particulars, such as services rendered, terms of payment, and due dates.

Clearly communicate your payment terms to clients, like due dates and any relevant late fees, to encourage timely reimbursements. Implementing a process for tracking overdue invoices and promptly following up with customers will help ensure you receive payments on schedule, which is critical for maintaining liquidity.

Step 6: Understand Obligations and Requirements

As the owner of a plumbing company, it is essential to comprehend your duties and what is expected to avoid penalties while maintaining compliance.

Plumbing businesses are subject to specific tax regulations. Some services may require collecting sales tax, particularly for material sales. This sales tax is collected in 45 states and the rate varies according to the location. Additionally, independent contractors and employees must have their earnings reported correctly, with the appropriate tax withholdings.

Step 7: Apply Accounting Software Effectively

Accounting software significantly streamlines bookkeeping when utilized properly. Look for features permitting expense tracking and categorization to monitor spending easily.

Reports are equally important, as they provide profit/loss statements and cash flow analyses with important insights into fiscal wellness. Integration compatibility with other employed tools like scheduling and invoicing software creates a seamless workflow, boosting productivity.

Step 8: Constantly Review Financials

Consistently reexamining finances is pivotal for plumbing company success. To evaluate commercial well-being, begin by scrutinizing statements, including income, assets/liabilities, and cash flow. Identifying and following pertinent benchmarks like gross margin and receivables turnover yields awareness of operational effectiveness. Use information from these reviews to modify strategies and enhance profitability, ensuring competitive plumbing industry positioning.

Step 9: Hire a Professional Accountant

Enlisting a seasoned accounting service like the Samcashflow Agency brings merits that optimize your financial administration. Such services navigate intricate tax laws with expertise, ensuring adherence to save you time and prevent pricey blunders.

Outsourcing bookkeeping allows you to focus on running your venture instead of being caught up in fiscal issues. Furthermore, a professional accountant provides valuable economic counsel, assisting with strategic planning and growth tactics aligned with your objectives.

Step 10: Stay Organized

Structure is fundamental to fruitful bookkeeping, and executing powerful organizational strategies can hugely enhance your accounting process. First, a systematic filing system should be created for all physical and digital fiscal records to facilitate finding files during tax season or audits.

Schedule regular assessments of your financials, dedicating time weekly or monthly to guarantee everything stays current and precise. Additionally, consider cloud storage solutions to safely back up your financials, permitting access from anywhere and ensuring a dependable backup in emergencies.

Struggling with the Bookkeeping of Your Plumbing Business in the US? Contact SamsCashFlow Agency!

Struggling with your bookkeeping needs? Choose expert professionals offering top-notch bookkeeping services at SamsCashFlow Agency. Visit https://www.samscashflow.com/#book and get comprehensive bookkeeping solutions for your plumbing business in America.

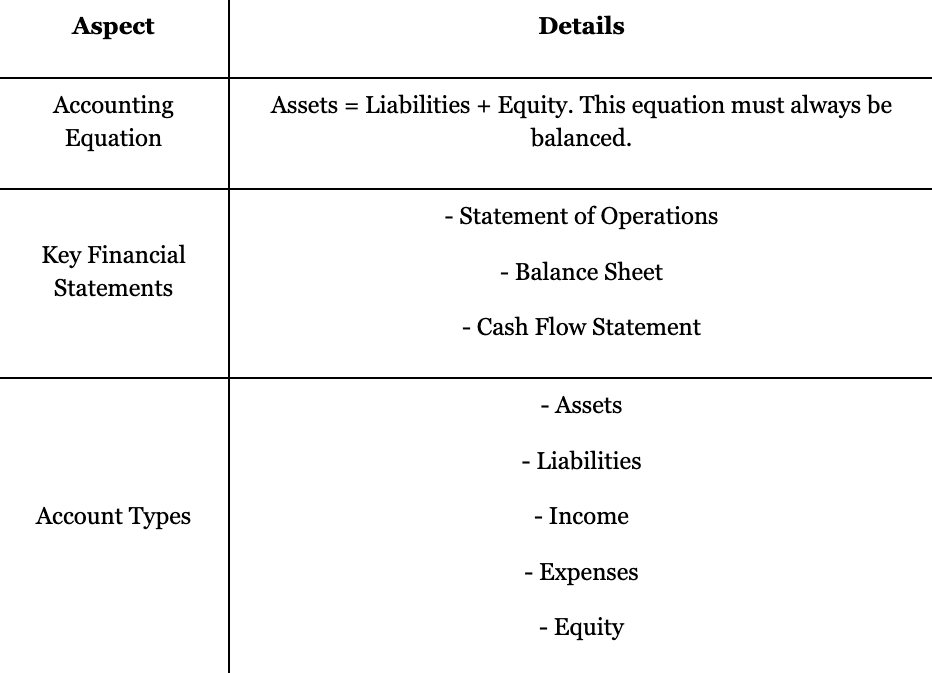

Appendix 1:

Aspect; Details

Accounting Equation; Assets = Liabilities + Equity. This equation must always be balanced.

Key Financial Statements; Statement of Operations; Balance Sheet; Cash Flow Statement

Account Types

Assets; Liabilities

Income

Expenses; Equity

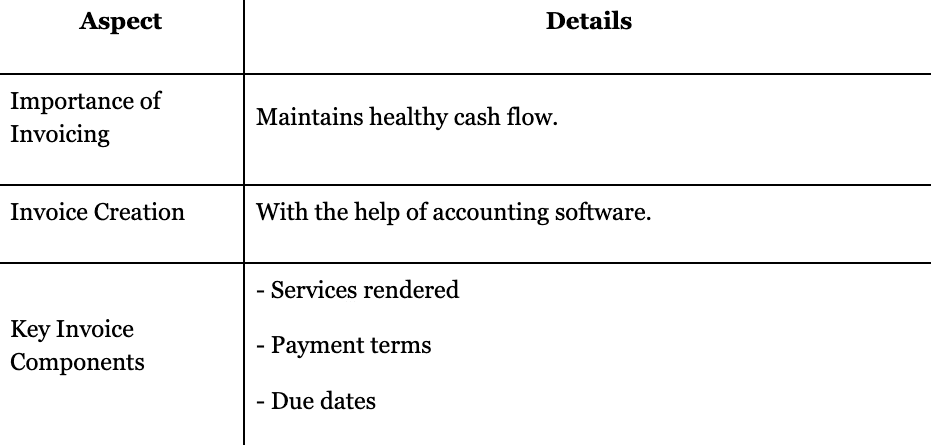

Appendix 2:

Aspect; Details

Importance of Invoicing; Maintains healthy cash flow.

Invoice Creation; With the help of accounting software.

Key Invoice Components; Services rendered; Payment terms; Due dates