How to Maximize Profits with Efficient Bookkeeping for Pet Care Businesses

As a pet care business owner, you know what matters most: taking amazing care of the animals. But at the end of the day, you need to keep your business profitable, too. That's where solid bookkeeping comes in. Whether you run a grooming salon or a boarding facility, understanding your numbers is essential. Let’s explore how other pet businesses have transformed their profits through better bookkeeping and how you can do the same.

Why Is Bookkeeping Important for Pet Care Businesses

When you first started your pet boarding facility, you didn’t spend as much time worrying about books as you did about caring for pets, right? This must have nearly cost you your business, well. Today, you have to realize that accurate financial records play a key role in making your pet care business successful.

Think about this: Have you ever thought of going through how many times your profits do not match your packed schedule? Or feverishly searching receipts during tax season? Bookkeeping properly gets rid of these hassles and keeps the books clear as to where you stand with your business financially. For tax compliance, it's important to help you claim all eligible deductions without being fined for erroneous tax returns.

Additionally, your organized financial records will help you make decisions on investment, staffing, and pricing as you decide to expand services to include, say, grooming. Without proper bookkeeping, this kind of strategic planning is quite impossible.

Step-By-Step Guide On How to Maximize Profits For Your Pet Care Business In The US

Step 1: Choose the Right Bookkeeping Method

If you've been in the small pet care business for any length of time, you will hear that most experienced small pet care businesses will tell you they do very well with cash-based accounting. To get started, you can use this method. It’s simple, and it tracks money as it moves in and out of your business. For example, when a client pays for their dog’s grooming service, you record the income, not when you schedule the appointment.

But as you grow your business to many locations, you’ll want to switch to accrual basis accounting. A more complex but more accurate picture of your business's financial health by recording income and expenses when they occur, regardless of when money is exchanged.

Step 2: Have a Comprehensive Chart of Accounts

For your pet care business, you can have categories like:

Revenue accounts: Retail of pet supplies, grooming services, boarding services

Expense accounts: Cleaning supplies, utilities, staff wages, pet food, supplies

Asset accounts: Improvements to facility and grooming equipment

Liability accounts: Credit card debt, business loans

Step 3: Track Income and Expenses

Revenue streams come in all shapes and forms in the pet care industry. For example, your business can generate income with boarding, daycare, grooming, and sale of pet products retail. Tracking each stream separately will help you find out which services are profitable.

Track business expenses across all categories - from day-to-day items like pet food and grooming supplies to your monthly utilities and marketing budgets. Here's what works for most businesses: Put everything on your business credit card and have it synced with your accounting software. It eliminates the need to manually input expenses at the end of each month.

Step 4: Manage Inventory

Pet care businesses need to do a good job with inventory management. Most businesses learn this lesson after they find expired pet food that costs their business hundreds of dollars. However, now you can apply First In First Out (FIFO) for perishable items such as pet food and grooming products. That means older stock is used first, reducing waste and maximizing profits.

Step 5: Handle Payroll and Taxes

Managing payroll for a pet care business can be complex since you'll likely have different types of workers. Your kennel assistants might work part-time, while groomers often work full-time hours. For employees, you'll need to handle all the usual tax withholdings - federal, state, Social Security, and Medicare. Some groomers prefer to work as independent contractors, in which case you'll need to track their payments and provide 1099 forms at tax time.

Step 6: Analyze Financial Performance

If you are a pet care business owner, then the monthly financial analysis is

your business compass. You should review key metrics like:

Revenue per service type

Number of average tickets per customer

Revenue comparison at peak and off-peak.

Staff productivity ratios

Percentage of revenue as operating cost

For instance, this analysis may show that you have the highest revenue with your boarding service but the best profit margins with your grooming service because of lower overhead costs.

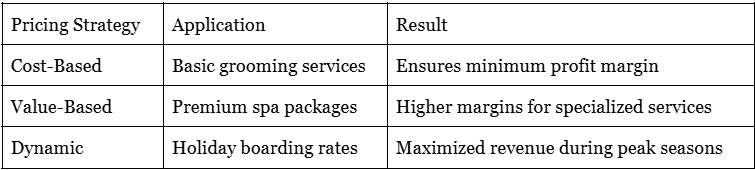

Step 7: Improving Pricing Strategies

Here's a simple breakdown of pricing strategies that most pet care businesses implement:

Too Much Hassle? Seek Professional Help From The Best: SamsCashFlow Agency!

When it comes to managing your pet care business's finances, you've got options. While DIY bookkeeping is possible, many business owners find that expert help makes a real difference – especially given the unique challenges of running a pet business, from managing multiple service types to handling seasonal fluctuations.

This is where SamsCashFlow Agency comes to aid. For instance, they once implemented automated billing for recurring services. They set up proper expense tracking for supplies and staff schedules to help a daycare unit increase its profit margins by 23% in just six months.

The right financial partner does more than crunch numbers. They'll track key data points like your client retention rates, average revenue per pet, and peak capacity hours – metrics that directly impact your bottom line. This insight helps you make informed decisions, like whether to add that new grooming service or when to hire another dog walker.

Book a call at SamsCashFlow Agency today!