How to Complete Form W-8BEN-E for a Foreign Corporation

At the end of 2023, foreign direct investments in the US reached $6.68 trillion. This underscores the importance of understanding US tax obligations for foreign corporations. Compliance with complex IRS regulations is absolutely essential for international businesses seeking to steer clear of unnecessary penalties and optimize their tax situations. Form W-8BEN-E, also referred to as ‘Certificate of Foreign Status of Beneficial Owner for U.S. Tax Withholding,’ occupies an important place within this landscape.

Submitting this form is pivotal for foreign firms aiming to validate their non-American standing, claim their rightful designation as a beneficial owner, and potentially reduce or entirely do away with withholding taxes in accordance with an applicable income tax treaty. The following article will guide you step-by-step through the details of filling out Form W-8BEN-E.

Steps to Fill Out the Form

A foreign firm engaging with a business based in the United States must complete IRS form W-8BEN-E. This intricate document is accessible on the IRS website for online or printed submission. The form includes 30 parts and stretches across multiple pages. Typically, only four sections require attention depending on entity type.

Let us get into the detailed instructions regarding the completion of this document.

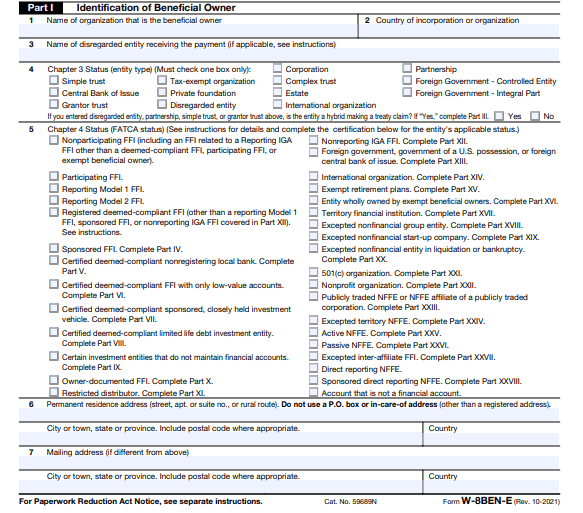

Step 1 - Identification of Beneficial Owner (Part I)

This part of the form usually requires most of your time. But the fields are quite easy to fill.

1. Name of Organization

Provide the full name of your company.

2. Registered Country

Write the name of the nation where your firm is registered.

3. Disregarded Entity’s Name

This part is not necessary when you are making direct payments. You can’t skip this section if no direct payment is made to the foreign entity at all and everything is done through US or foreign sources like an accounting firm.

The involvement of a third party also requires you to fill out Part II of this form. In that section, you need to provide a description of the branch receiving payment, called the disregarded entity. The details to include are as follows:

GIIN (if applicable)

Address (no P.O. box)

Chapter 4 status

4. Chapter 3 Status

A corporation is the usual choice under this section. Most foreign entities usually fall under the category of a corporation or partnership business in the US. Some other options are as follows:

Estate

Foreign government

Central Bank of Issue

Simple trust (grantor and complex)

Private foundation

Tax-exempt firm

International organization

At times, your business might not fall under any of the available categories. In that case, remember that a corporation is the obvious choice for a solely owned business. If multiple people own it, it can be a partnership.

5. Chapter 4 Status (FATCA Status)

The mainstream choice under this section is Active NFFE. It indicates the status of an Active Non-Financial Foreign Entity. Choose this as long as none of the other options fit you well.

The FATCA status signifies which parts of the WBBEN-E form you need to fill out later.

Ignore all options related to FFI as long as you are not a bank, insurance, or investment fund.

6. Permanent Resident Address

This denotes the address of the foreign organization.

7. Mailing Address

No need to fill out this section again if it is the same as your permanent residence details.

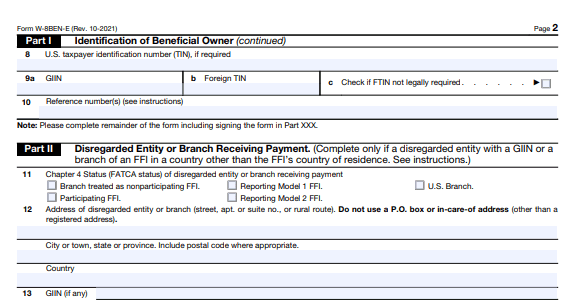

8. Tax Identification Information

Being a non-American entity, you have minimal chances of getting a US taxpayer identification number. In these scenarios, you will have to provide the number used by local tax authorities for identification. Find this number from the foreign paperwork or vendor returns.

Step 2- Claiming Tax Treaty Benefits (Part III)

This section requires you to check the relevant box. You might also have to provide your country of origin.

14a: Check the box and write the name of your origin nation

14b: Simply check the box.

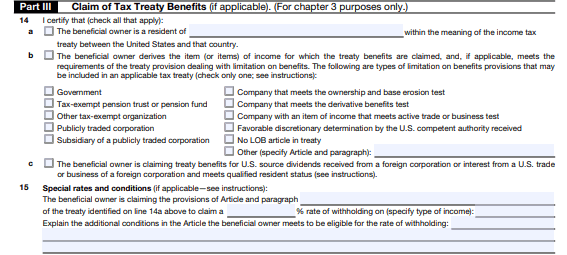

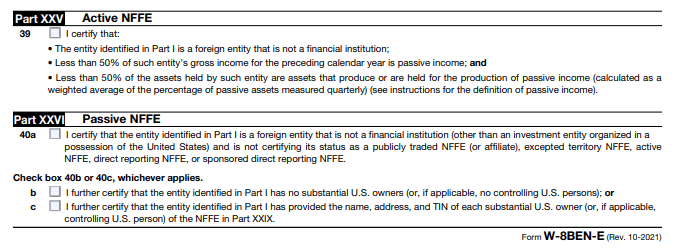

Step 3- Active NFFE (Part XXV)

This section requires you to check box 39. Doing that means:

The entity you specified in Part I is a foreign entity. It is not a bank or financial organization.

Less than half of the gross income for the last calendar year has been generated through passive sources.

Less than 50% of the held assets provide yield or are acquired for generating passive income.

You should remember that a Passive NFFE needs to fill Part XXIX. That section is in no way similar to Part XXV.

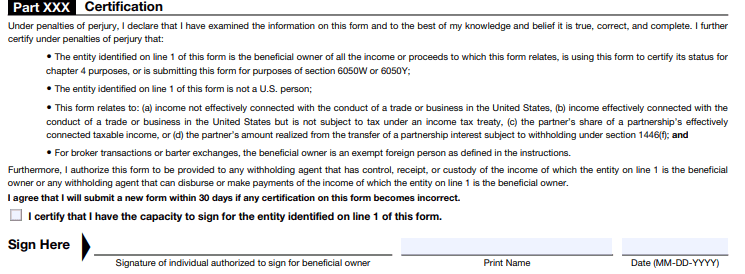

Step 4- Certification (Part XXX)

After filling out this form, you need to put your signature on it. Mention your first name as well as your last name. Additionally, provide the date of signing the form.

Validity of Form W-8BEN-E

This form remains valid for three years. The validity begins on the date of signing and ends after three years from that. It will expire on the last day of the third calendar year. If the data found on the form is inaccurate, it won’t be considered valid at all.

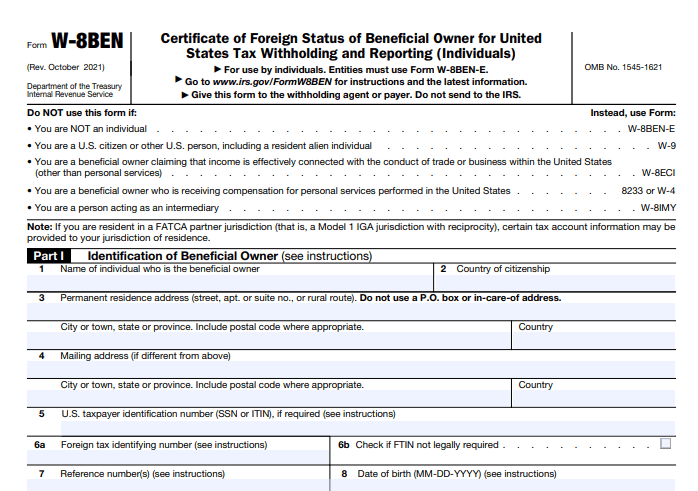

Is Form W-8BEN the Same as Form W-8BEN-E?

W-8BEN-E is for non-American entities, including organizations and companies. But Form W-8BEN is for sole proprietors or foreign individuals. It is for a sole proprietor or individual who is likely to bear a tax rate of 30% on the domestic income of a foreign entity.

The W-8BEN form is for claiming the status of a sole proprietor or individual as an NRA. The W-8BEN-E tax form is usually a bit longer. It is for companies and organizations and not sole proprietors or individuals.

Consequences of Failing to Fill Out Form W-8BEN-E

If a foreign company does not submit this form, they have to pay the full tax rate of 30%. According to the terms of section 3406, failing to fill out this form can lead to a different backup withholding rate.

Need Help While Filling Out W-8BEN For A Foreign Corporation? Get In Touch With Samscashflow Agency

Finding it difficult to complete Form W-8BEN? Book a call with experts from SamsCashFlow Agency today!