Step-By-Step Guide On How To File Taxes for a Divorce Law Firm in The USA

Introduction

While filing taxes is an inevitable aspect of operating any legal firm in America, including a Divorce Law Firm, taking a faulty approach can lead to needless penalties and difficulties with the IRS down the road.

To avoid such headaches and ensure compliance with the tax codes year after year, it is advisable to establish a structured yet adaptable regimen for documenting expenses, revenues, and other critical financial details.

“According to statistics there were as many as 4,50,000 functioning law firms in America in 2023.”

In the following comprehensive outline, we will delineate each critical phase involved in submitting taxes for your Divorce Law firm, emphasising balancing proper record-keeping with unforeseen contingencies that may demand periodic adjustments.

Steps On How To File Taxes for a Divorce Law Firm

Let’s begin by understanding how to file taxes for your divorce law firm.

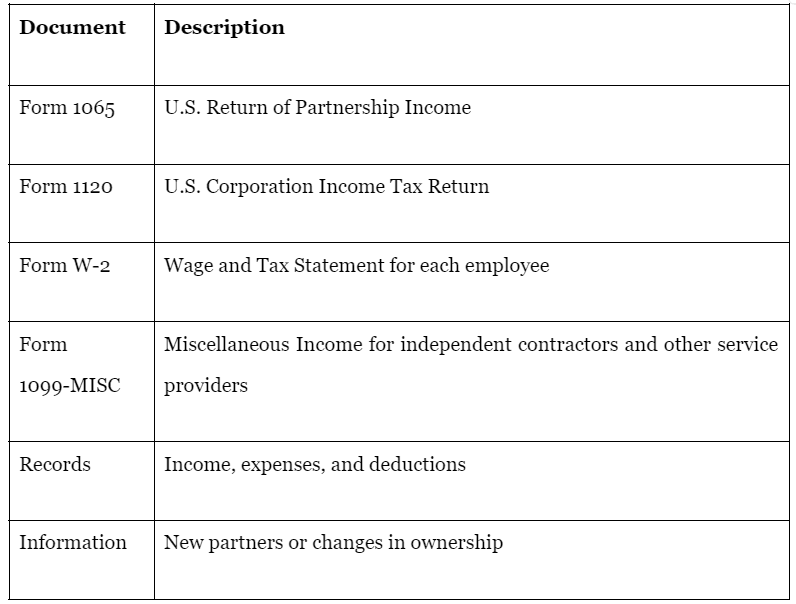

Step 1. Gather Necessary Documents and Information

Here’s a look at the required documents -

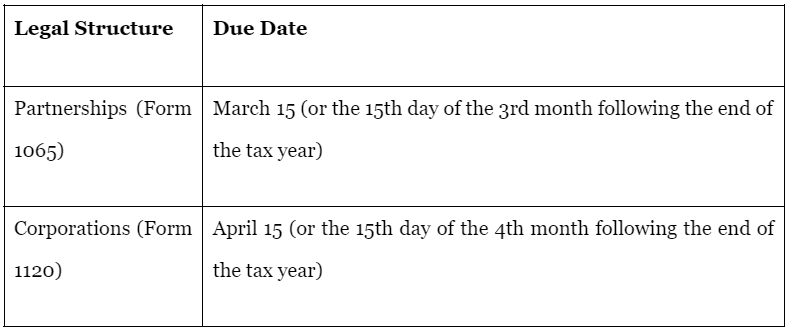

Step 2. Determine Your Divorce Law Firm's Tax Obligations

Your firm's legal structure (e.g., sole proprietorship, partnership, corporation)

The states and local jurisdictions in which your firm operates

Any international business activities

Types of taxes your Divorce Law Firm may be subject to:

Federal income tax

State income tax

Payroll tax

Self-employment tax

A key task is ascertaining your Divorce Law Firm's tax obligations. These will rely upon specifics comprising your company's authorized formation, the states and local territories where your enterprise functions, and any intercontinental commercial procedures. It is critical to comprehend fully the numerous taxes your Divorce Law Firm could undergo, such as federal income tax, state income tax, payroll tax, and self-employment tax.

Step 3. Calculate Your Divorce Law Firm's Income and Deductions

Filing accurate taxes requires calculating your Divorce Law Firm's total revenue and permissible deductions. Gross earnings from legal work and other sources must be tabulated, along with expenditures like wages, rent, utilities, and office supplies. Deductions may include the business utilization of a home office, travel, and professional advancement.

Maintain records of all revenue and costs year-round to simplify tax submission. Moreover, taxpayers should crosscheck previous filings for consistency in reported figures while exploring additional breaks for small businesses. Although the procedure needs patience, getting it right prevents future complications and protects the firm's financial health for years.

Step 4. Determine Your Divorce Law Firm's Tax Filing Method

There are several choices for submitting a Divorce Law Firm's taxes, such as through paper filing with IRS forms, electronic submission through the government website or a third party's software, hiring a tax specialist, or utilizing tax preparation software.

The Free File option handled through the IRS allows online filing free of cost provided income remains under the threshold and the tax situation is not too complex. Yet for more involved scenarios, it is usually preferable to seek a tax expert's guidance or use customized tax preparation softwares.

Step 5. File Your Federal Tax Return

Request an extension from the IRS if you need more time to file

An extension to file is not the same as an extension to pay

Step 6. File State and Local Tax Returns

While filing your federal tax return is crucial, operating a Divorce Law Firm means taking additional steps. It requires conforming to the tax statutes of any state or municipality where business is transacted. Due dates and specifications are not uniform across taxing bodies, so carefully examining each authority's demands is mandatory.

Some states parallel the federal deadline, while others have divergent dates that require attention. Consideration must also incorporate any required estimated payments as the year progresses. Compliance protects the business and enables continued assistance to clients seeking divorce services.

Step 7. Keep Accurate Records and Stay Organized

Throughout the tax filing period and beyond, keeping precise records and remaining organized is fundamental. Maintaining meticulous documentation of profits, expenditures, and deductions, retaining copies of all returns submitted, and assisting with paperwork prove exceptionally valuable. Similarly noteworthy is keeping track of any modifications in tax rules and policies that often occur.

Conclusion

Filing taxes is never simple, especially for a Divorce Law Firm dealing with complex client situations. While compliance with various tax codes takes diligence, following a systematic process makes the workload manageable.

Having a tough time dealing with all the paperwork and procedures? You don’t need to manage it all by yourself anymore. Contact the Samscashflow agency and leave it to the expert professionals.