Step-By-Step Guide On How To File Taxes for Plumbing Business For USA Companies

Filing taxes for a plumbing business in the United States can be a complex maze, but remaining organized and taking a systematic approach allows one to meet all obligations. This guide outlines the comprehensive process of properly submitting taxes for your plumbing enterprise, ensuring compliance while maximizing potential deductions.

Step 1: Understanding Your Business Structure

Understanding your business structure is the initial step in determining your tax submission method. Most plumbing outfits operate as sole proprietorships, partnerships, or corporations. For a sole proprietorship, business earnings are included on the owner's personal return using Schedule C. Partnerships require Form 1065 to report income/expenses, with profits/losses passing to partners' individual filings.

Incorporation necessitates either Form 1120 for a C corporation or Form 1120-S for an S corporation. Each structure yields different tax repercussions, so correctly discerning your classification impacts submission duties.

Step 2: Gathering Necessary Documentation

With structure identification completed, the next phase involves assembling all pertinent records. Plumbing businesses often deal with a wide range of transactions, from service calls and installations to large-scale projects. Income statements should detail all revenue from these activities.

Maintaining accurate bookkeeping in a ledger listing all transactions, invoices, and receipts is fundamental for substantiating submissions. For a plumbing business, this includes documenting costs such as:

Employee wages: This includes salaries for plumbers, administrative staff, and any apprentices or trainees.

Plumbing equipment and tools: The cost of purchasing, maintaining, and replacing tools like pipe wrenches, augers, cutters, and other specialized plumbing gear.

Training and certification: Expenses related to training and certifying plumbers are necessary for staying compliant with industry standards.

Insurance: Liability insurance is crucial in plumbing due to the nature of the work, covering potential damages or accidents on job sites.

Vehicles: The costs of maintaining and operating service vans or trucks, including fuel, repairs, and insurance.

Owners with staff must collect W-2s detailing wages and withholdings. Independent contractors need 1099 forms. You must also maintain copies of business licenses, permits, and any additional certifications relevant to plumbing work.

Step 3: Understanding Your Tax Obligations

As the proprietor of a plumbing business, you have an assortment of fiscal duties to fulfill. Chief among them is paying federal income tax on the enterprise's profits. If operating as a sole proprietor or partner, you'll also be liable for self-employment taxes covering Social Security and Medicare contributions typically withheld from wages.

If employing others, federal earnings tax, Social Security, and Medicare deductions must be extracted from worker paychecks. Additionally, the employer's share of such levies must be compensated. Understanding payroll tax obligations is indispensable to dodging penalties and confirming adherence to IRS standards.

Beyond national taxes, state and local fiscal responsibilities may apply, too. Location contingent obligations could encompass remitting state income tax, sales tax on select services, property taxes, or business licensing fees. Each state body has its regulations. Thus, familiarizing yourself with precise directives where you work is important.

Step 4: Calculating Your Taxable Income

Calculating taxable income is a crucial step in filing one's return. To ascertain taxable income, subtract aggregate business expenses from total revenue. This calculation yields the net profit.

Attentiveness and correctness in calculating expenses are paramount since this directly impacts taxable income. For plumbing businesses, common deductible costs encompass:

Material costs: Pipes, fittings, valves, and other materials necessary for completing plumbing jobs.

Depreciation of equipment: Plumbing tools and vehicles can be depreciated over time, reducing taxable income (Section 179).

Office expenses: This includes rent, utilities, office supplies, and any software or systems used for scheduling and managing plumbing jobs.

By exploiting deductions to their fullest, one can substantially diminish taxable income and lower the tax liability.

Step 5: Submitting Your Income Tax Return

Once estimations of taxable income have been calculated, it is now time to submit the annual income tax return. One could opt to file electronically or, traditionally, by postal mail. Electronic filing is often easier and might quicken the return processing. Numerous tax preparation software programs are accessible to help you through the process, ensuring all necessary forms are filled precisely.

Should mailing be favored, the relevant tax forms contingent on business classification would need completion. For instance, sole proprietors would use Schedule C along with Form 1040, while partnerships would need Form 1065. Corporations would employ Form 1120 or Form 1120-S.

When submitting the tax return, include all requisite attachments, such as W-2s, 1099s, and other supporting documentation.

Step 6: Paying Your Taxes

If you determine that taxes are due, paying by the due date is vital to avoid penalties or added interest. You can pay electronically through the IRS website using the Electronic Federal Tax Payment System. This allows scheduling payments ahead of time, facilitating cash flow management.

Alternatively, mail a check or money order along with the tax return. Be certain to check the IRS website for the proper mailing address, depending on the type of tax return filed.

Step 7: Maintaining Documentation

After submitting a tax return, keeping accurate ledgers of business profits and expenses is imperative. The IRS advises retaining these records for no less than three years following filing, as this is the span wherein an audit could occur. Proper record maintenance will assist in the case of an audit and provide important insights regarding a business’s fiscal wellness.

Consider employing a systematic approach to record maintenance, like using accounting software or hiring a professional accountant. This will help you stay organized and make all required documentation available for future tax filings.

Step 8: Consulting a Tax Specialist

While this guide offers a comprehensive overview of the tax submission process for plumbing businesses, it is important to recognize that tax laws can be intricate and prone to change. Consulting a tax specialist like SamsCashFlow Agency can be smart, especially if questions about deductions, credits, or specific tax scenarios are unique to a business.

Struggling to File Taxes for Your Plumbing Business in the US? Contact SamsCashFlow Agency!

Let the qualified tax advisors at Samscashflow Agency help you navigate the intricacies of tax regulations, ensuring compliance. Visit https://www.samscashflow.com/#book and call them to get customizable solutions for your plumbing business.

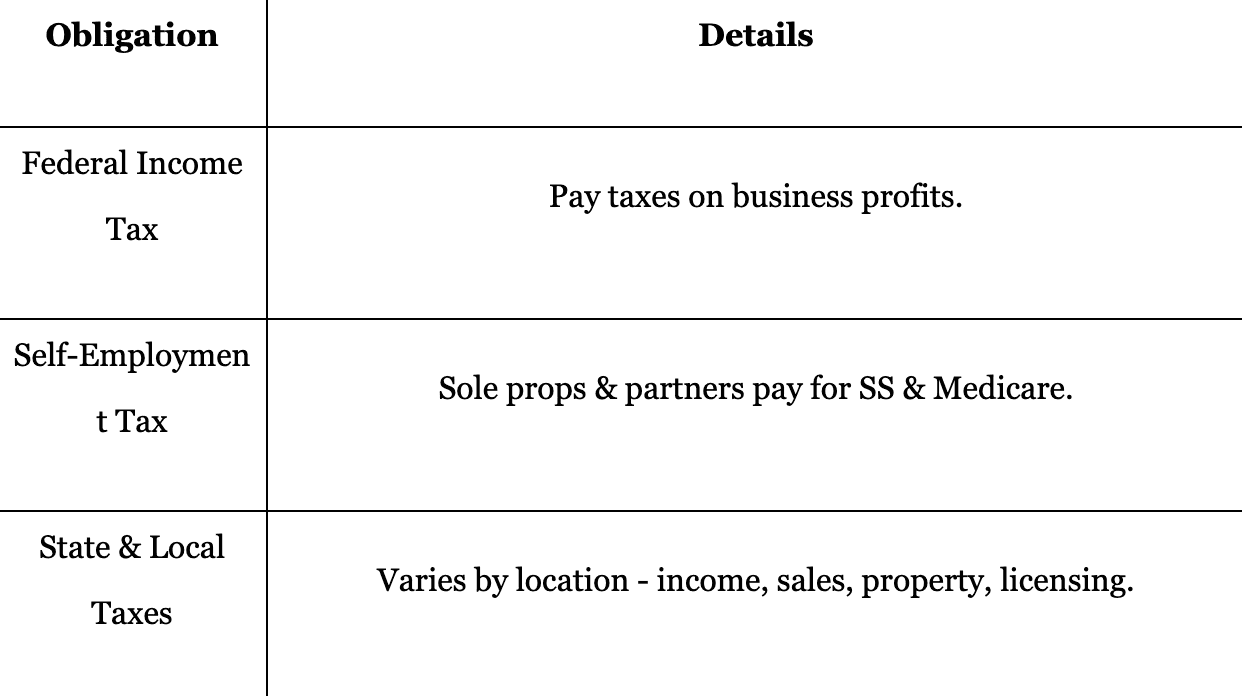

Appendix 1:

Obligation; Details

Federal Income Tax; Pay taxes on business profits.

Self-Employment Tax; Sole props & partners pay for SS & Medicare.

State & Local Taxes; Varies by location - income, sales, property, licensing

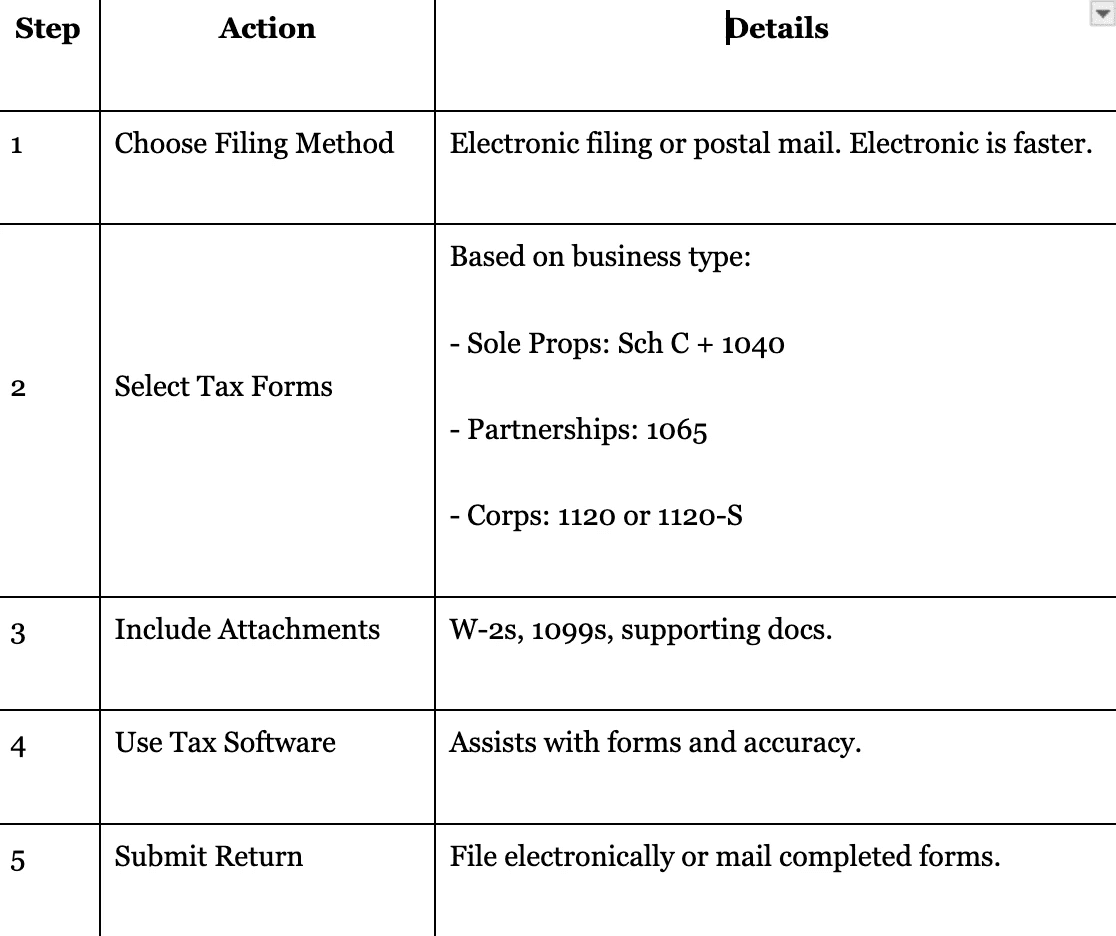

Appendix 2:

Step; Action; Details

1; Choose Filing Method; electronic filing or postal mail. Electronic is faster.

2; Select Tax Forms; Based on business type:

Sole Props: Sch C + 1040; Partnerships: 1065; Corps: 1120 or 1120-S

3; Include Attachments; W-2s, 1099s, supporting docs.

4; Use Tax Software; Assists with forms and accuracy.

5; Submit Return; file electronically or mail completed forms.