Step-by-step Guide On How To File Taxes for Social Media Agency / SMMA For USA Companies

Navigating the tax landscape for a Social Media Marketing Agency (SMMA) in the USA demands nuanced comprehension, yet establishing conformity is crucial for fiscal prosperity and acquiescence. As digital marketing persists— forecasted to attain $980.2 billion globally by 2026—social media agencies experience unprecedented scalability.

However, with growth arrives accountability, particularly regarding levy liabilities. Submitting taxes accurately isn't solely about avoiding penalties but optimizing your agency's profitability. Here is an itemized guide on submitting taxes for your SMMA, ensuring you follow federal and state laws.

Step 1: Look Into Your Business Structure

Your business structure dramatically impacts how your social media marketing agency is taxed. The most common setups incorporate:

Sole Proprietorship

This is the default framework for single-owner ventures. Income and costs are accounted for on your private tax return. While it's the most straightforward structure, it lacks the liability shield found in other choices. This means your assets could be at risk in the event of a lawsuit or debt.

Partnership

This framework is used when two or more individuals share business possession. The company itself does not pay taxes. Instead, income and expenses are passed through to the partners, who report their share on their private tax returns. The partnership files an informational return outlining the business's income and other tax-related facts.

LLC

This structure provides liability protection while offering flexibility in taxing the business. If it has a single member, it is typically taxed as a sole proprietorship. However, multi-member LLCs are taxed as partnerships unless they choose to be treated as corporations.

Corporation

A C-Corp is seen as a separate entity, meaning it pays corporate taxes on its profits, and shareholders also pay taxes on dividends. An S-Corp, on the other hand, permits gains and losses to be passed through to shareholders' tax returns, avoiding double taxation.

Step 2: Understand Federal Tax Obligations

At the federal level, your SMMA must comply with specific tax obligations depending on how it is legally organized. Filing returns accurately and promptly is imperative to circumvent consequences for deficiencies or tardiness.

Sole traders and partners are accountable for self-employment taxes, which fund Social Security and Medicare individually rather than through withholdings from wages. This levy, currently 15.3%, is bifurcated with 12.4% for retirement and 2.9% for medical insurance.

Those forecasting obligations surpassing $1,000 must prepay estimated payments quarterly to avoid penalties. Besides, C-corporations are exempt from this prerequisite.

If the business acquires staff, management must withhold and remit taxes on income, as well as the employer's share for offering employment benefits.

Step 3: Decode State Tax Obligations

State tax burdens fluctuate considerably depending on where your SMMA functions.

Most states demand companies to secure a permit or license to perform lawfully. This progression regularly involves signing up your business with the state's Department of Revenue or Secretary of State.

If your state imposes it, you'll need to submit a state income tax return according to the construction of your business. For example, in states like California, LLCs are asked to pay an annual minimum franchise tax, even if the business didn't gain any income during the year.

Your SMMA might need to collect sales tax on particular digital products or services sold to customers. For example, some states tax the sale of digital advertising services.

Some states charge a franchise tax for the privilege of doing business there. The amount is usually based on the company's income or revenue, and you must file an annual return with the state's tax authority.

Step 4: Track Deductions and Credits

Social media agencies have several opportunities to lessen their tax duty through deductions and credits:

Home Office Reduction: For those who run their SMMA from home, you can subtract costs linked to your workspace. This deduction is accessible for homeowners and renters and covers some of the costs like lease or home loan interest, utilities, insurance, and upkeep. The area must be used routinely and exclusively for business.

Employee Salaries and Advantages: Salaries, bonuses, and worker advantages similar to health insurance contributions are subtractible. This additionally includes funds to independent contractors, which should be reported on Form 1099-NEC.

Retirement Contributions: Contributions to worker retirement plans, including your personal if you're self-employed, are subtractible. Widespread retirement plans embrace SEP IRAs, SIMPLE IRAs, and Solo 401(k)s.

Step 5: File the Correct Tax Forms

Filing one's taxes accurately is crucial to circumvent penalties. Here are some forms your SMMA may need:

Form 1040 (Schedule C) is for the self-employed to illuminate earnings and costs. This attachment to a personal return itemizes a venture's income, outlays, and net profit or deficiency.

Form 1065 allows partnerships to enlighten income, deductions, and credits. Each partner acquires a Schedule K-1, which exposes their allocation of the entity's income and is submitted with their private return.

Form 1120 is for C Corps, while Form 1120S reports income, subtractions, and credits for S Corps.

Form 941 or 944 reports payroll taxes. Employers use these to illuminate federal income tax, Social Security, Medicare withholdings from worker wages, and the employer's share of Social Security and Medicare taxes.

Form 1099-NEC is for payments to independents. When remunerating an independent specialist $600 or more annually, one must furnish a Form 1099-NEC and file a copy with the IRS.

Form W-2 and W-3 report employee pay and withholdings. Workers acquire Form W-2, while Form W-3 summarizes all W-2s submitted to the Social Security Administration.

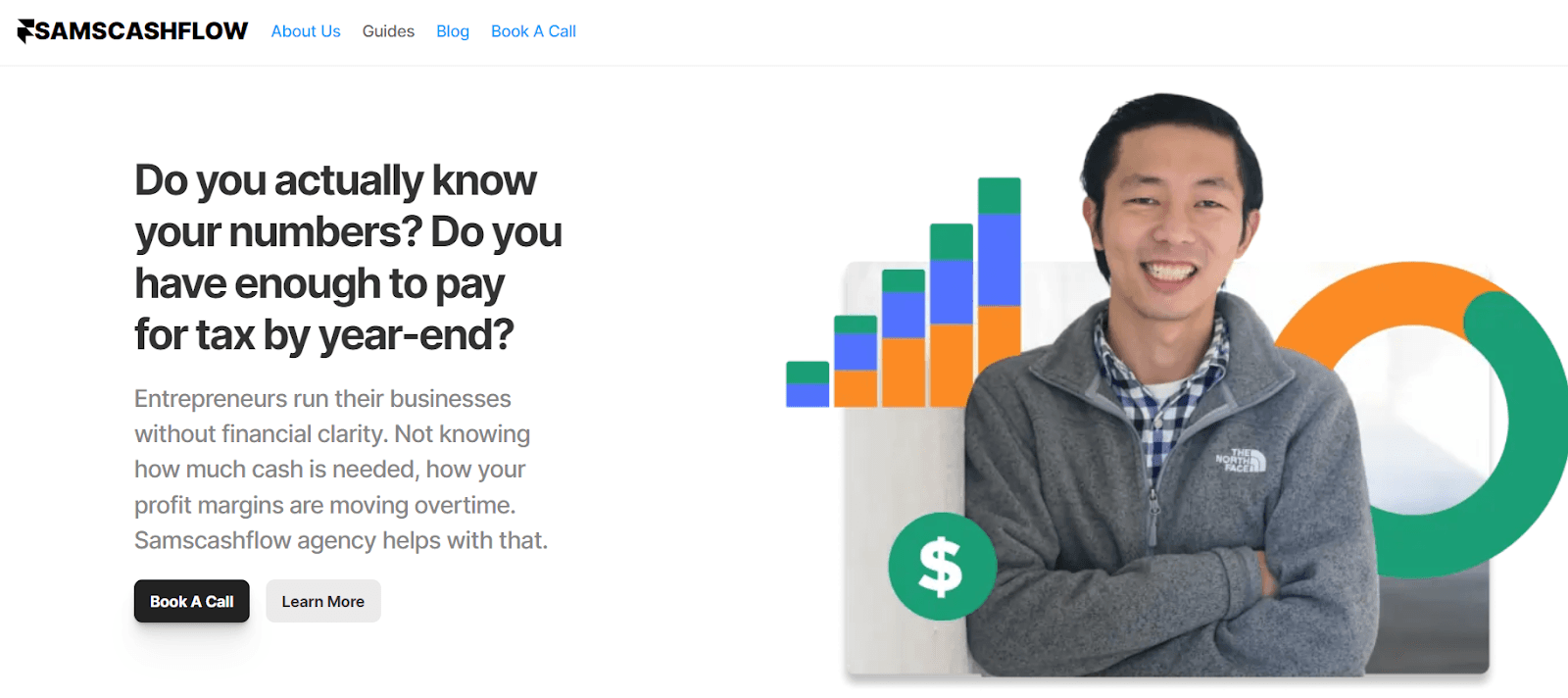

Struggling to File Taxes for Your SMMA in the US? Contact SamsCashFlow Agency!

Do you need expert assistance to file taxes for your SMMA in the US? Visit https://www.samscashflow.com/#book and contact the professionals at Samscashflow Agency.