How To File Taxes For Your USA LLC For Non-US Residents

In most cases, it becomes difficult for non-resident LLC owners to understand the level of complexity of the tax system in the United States. As for the article, it will give you a clear understanding of the prerequisites and the specific steps involved in filing taxes for proper and timely compliance. So, let’s start.

How to File Taxes for Your US LLC as Non-Resident: A Simple Step-By-Step Guide

Step 1: Understand and Know Your Non-Resident Alien Status

When addressing the US taxes for your LLC, it is necessary to define your non-resident alien status. However, there are restrictions for non-US citizens from opening enterprises in the nation. This has a tremendous effect with regard to your taxes.

You may already know the primary benefit of operating your business within an LLC is the ability to not pay federal income tax as a non-resident alien on the business profits. However, this exclusion is only permissible to persons who have no federal taxation obligation in the United States and the residents of countries that do not impose personal income tax.

However, for one to be allowed this tax relief, all the members of the LLC must be non-resident immigrants. The IRS will only classify you as a NRA if you do not meet the substantial presence test or you do not possess any of the following: citizenship in the United States or a green card.

Step 2: Understanding The LLC Tax Forms For Non-US Residents

Non-resident owners must file specific US tax forms to determine whether or not their US LLC earns taxable revenue. These specific forms vary based on the ownership, income, and structure of your LLC. Here is an overview for you:

Tax Forms for Single-Member LLCs

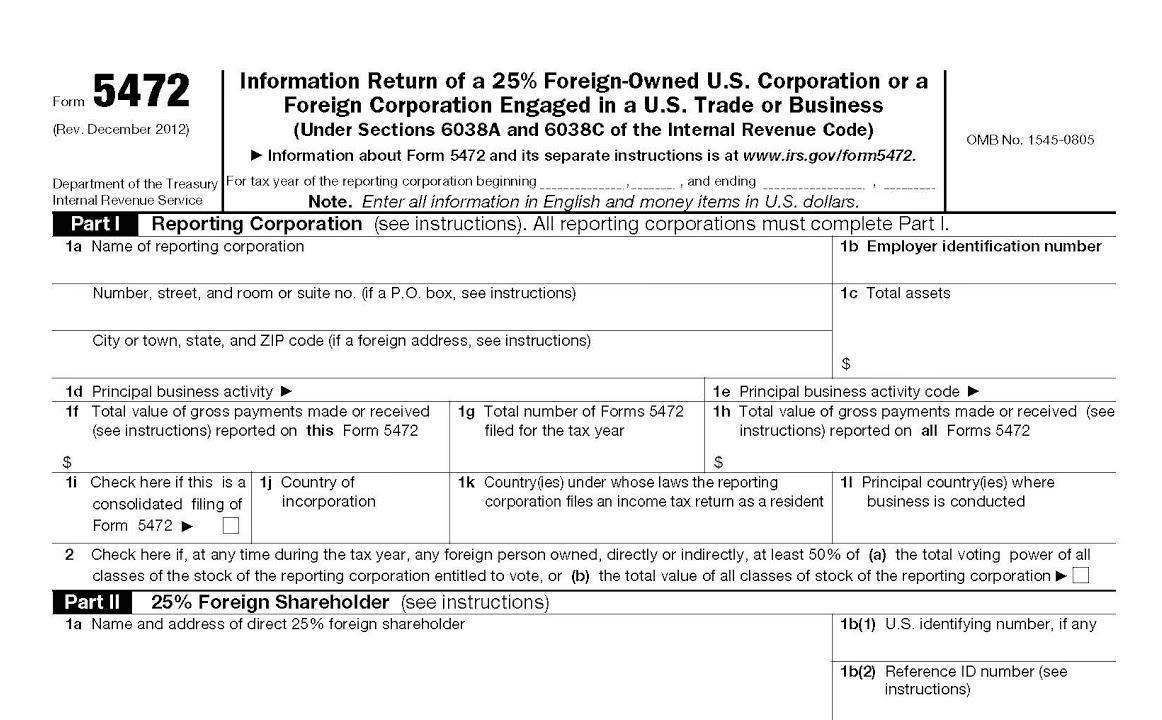

Form 5472 + pro forma Form 1120: Needed when the LLC generates US-sourced income.

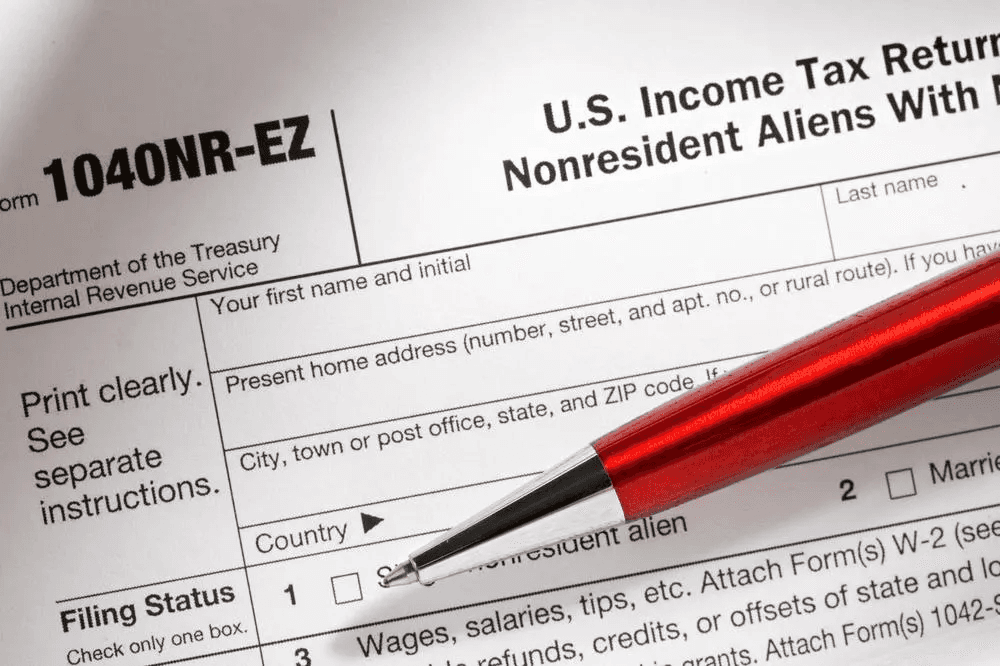

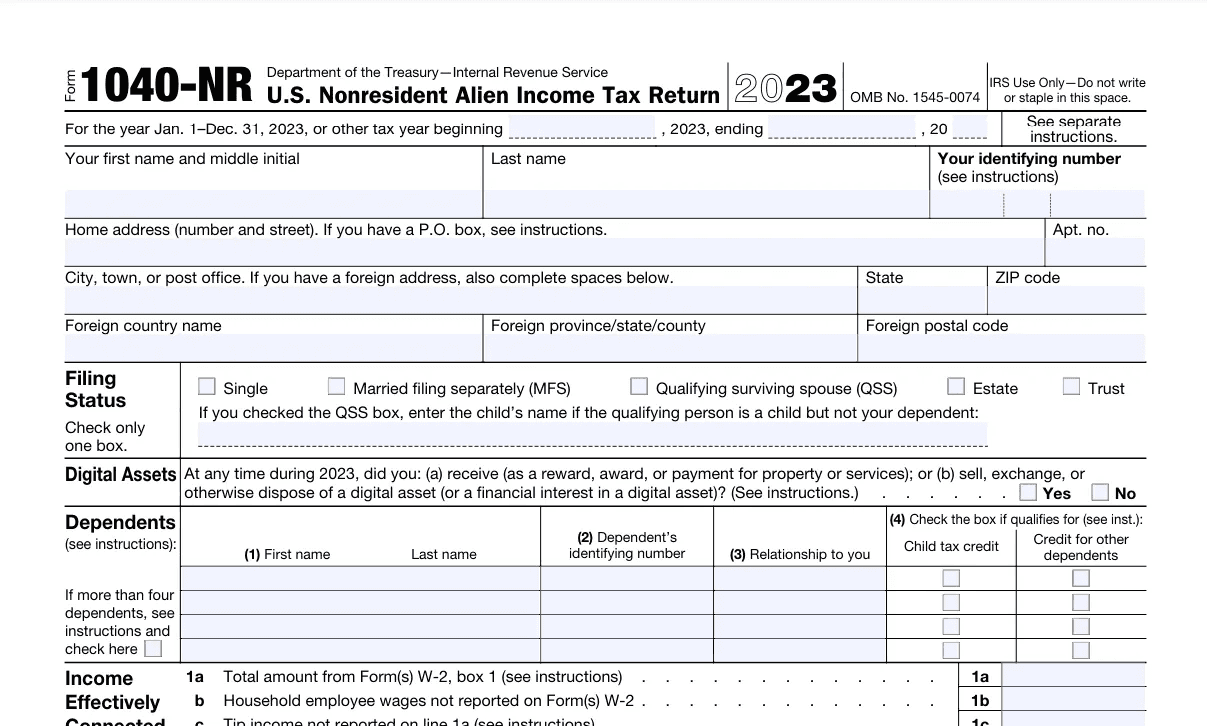

Form 1040NR: For the individual owner if there's no tax withheld or additional income.

Tax Forms for LLCs Treated as Corporations

Form 5472: Must be submitted if a single foreign person owns 25% or more.

Form 1120: Applicable only to the corporation.

Form 1040NR: This is for individual shareholders if no tax is withheld or additional income is required.

Tax Forms for Multi-Member LLCs

Form 1065: Needed if your LLC generates US-sourced income.

Form 1040NR: Required if there is no tax withheld or no additional income by the individual members.

Form W8-BEN: Needed from each LLC partner in case of withheld royalties.

Note: This is a basic overview. Specific circumstances may require additional forms. Consulting a tax professional is strongly recommended.

Step 3: Understand Your Tax Obligation

It can be challenging to determine your taxation status if you are a non-resident of America and you own a US LLC. In most circumstances, only income generated from carrying on a business in the US is subject to taxation to your LLC in the US.

Nevertheless, irrespective of the sort of business relation, income from the US may be taxed at a rate of only 30% withholding tax. Importantly, the existing taxation treaties between the United States and your country of origin may determine the amount of taxes you pay.

It is strongly advised to consult with a tax and finance expert such as SamsCashFlow Agency, which can help you with accurate adherence to the laws to avoid additional taxes.

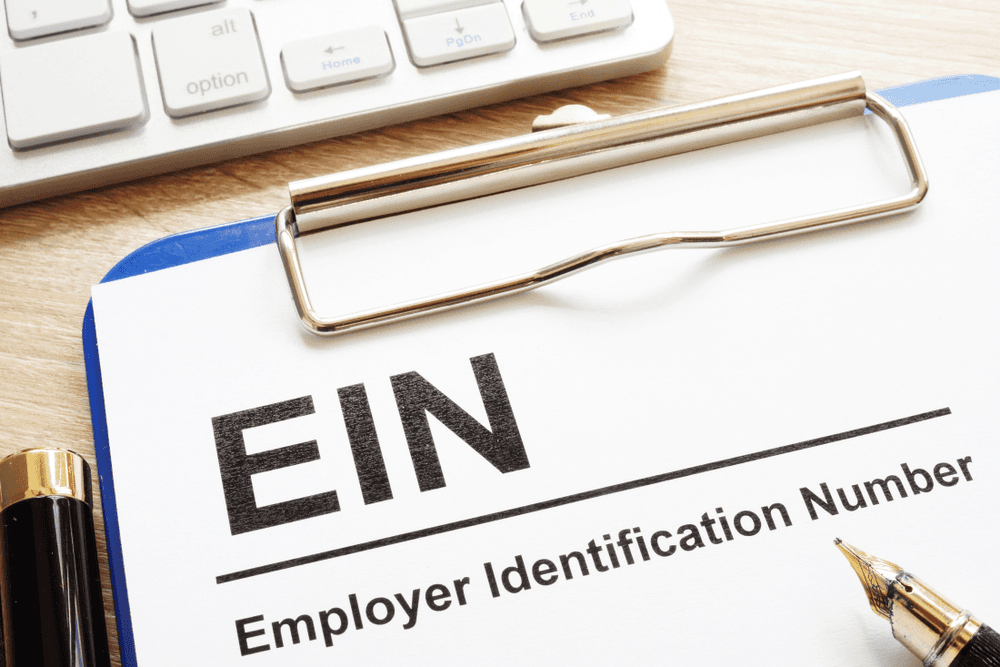

Step 4: Apply For an EIN

US tax filing for non-resident owners of LLCs requires the EIN, which is the Employer Identification Number. These special nine digits are your company's tax identification number. Before obtaining an EIN, the IRS Form SS-4 has to be filled out.

Foreign applicants may have to fax or mail the application even if they can apply online usually. Do not forget to store a copy of the EIN for future usage. In case of any changes in the details of your company, you have to fill out and file Form 8822-B to update the IRS records.

Step 5: Submit Form 1040NR For Individual Tax Return

Submitting Form 1040NR, which is your personal income tax return, is the final but perhaps the most crucial step in your LLC’s tax process as a non-resident alien (NRA). Also, note that before you can fill out this form, you must have an individual tax identification number (ITIN).

Certain fields in the 1040NR require specific information with reference to the taxpayer’s own situation, such as the exact amount of taxes to be paid and the exact income segment that is required to be taxed under the US federal income tax withholding.

Note that the Form 1040NR has to be filed before April 15, and this is the standard tax filing date. So, to maintain tax compliance and avoid fines, submit this filled-in form in due time.

Step 6: Submit Form 5472 For The LLC

Foreign owners of single-member LLCs must file Form 5472, even if their LLC is tax-exempt in the United States. Here is what you need to know:

Proforma Form 1120: All that is required to go along with Form 5472 is the first page of Form 1120, which is a corporate tax return.

Reporting Transactions: All transactions, whether direct (such as money transfers) or indirect (such as paying invoices to the LLC, transferring money through the LLC, or paying company expenses), are recorded on Form 5472.

Specifics to Remember: For transactions concerning family members or other entities you own, pay close attention to their specific laws.

Emphasize Transactions: Unlike standard tax returns, Form 5472 does not ask about sales or income. It only addresses the transactions you have with the LLC.

Penalties and Deadline: The deadline for Form 5472 is April 15. A major $25,000 fine may be incurred for not filing these tax forms.

Remember, while Form 5472 might seem complex, understanding its requirements is crucial for maintaining tax compliance.

Step 7: Getting Professional Tax Assistance

Although the preceding steps offer an excellent starting point for managing US tax filing as a non-resident LLC owner, consulting with an experienced tax specialist is highly advised. Businesses that specialize in this field, like SamsCashFlow, are able to offer customized advice that ensures the highest levels of tax compliance and efficiency.

By leveraging their expertise in intricate tax rules and regulations, you can minimize risks, maximize deductions, and attain tranquility. Remember that preserving your LLC's good standing and avoiding fines depends on timely and precise tax reporting.

Need to File Taxes For Your US LLC As Non-Resident? Contact SamsCashFlow Agency

Don't want to let tax issues put a halt to the expansion of your company? Wish to file taxes for your USA LLC for non-US residents? Click here, https://www.samscashflow.com/#book, book an appointment, and let SamsCashFlow Agency take care of your US LLC tax returns!

Our team of skilled experts offers solutions that are specifically designed to fit your needs, and we are aware of the special difficulties that non-resident LLC owners encounter.