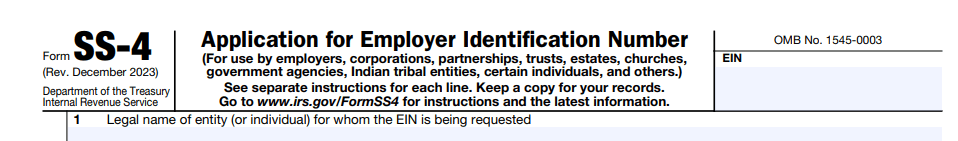

How To Complete Form SS-4 And Get An EIN For A Foreign-Owned USA LLC

LLCs with foreign ownership should ensure they acquire an Employer Identification Number (EIN). The IRS has given this special nine-digit number of your company and acts as the tax identification number. With this guide, get your EIN faster by learning the steps involved in how to fill out the IRS Form SS-4.

We will provide you with precise steps and guidelines to help you finalize the process, no matter if you choose to do it using a phone application, if you need to send it via mail as it was done many years ago, or if you prefer the opportunity to apply online.

Step-By-Step Guide On How To Complete Form SS-4 For US LLC Owned By Non-Residents

Step 1: Enter The Entity’s Legal Name

Your social security number, partnership agreements, and charters, among other formal documents, must exactly match your legal name as required by the IRS. Here's a simple guide to help you enter the legal name accurately based on the sort of entity you are dealing with:

Step 2: Enter Your Business’s Trade Name

If the company name differs from the legal name, enter the alternate name. Essentially, the "doing business as" (DBA) name should be the commercial trade name.

Step 3: Enter The Name of the Trustee, Administrator, Executor, and ‘Care Of’

Provide the trustee's name if your LLC is a trust. Give the name of the executor, administrator, or personal representative for estates. You can also put the name of a specific person as the "care of" person to designate that person to receive tax information. For proper identification, don't forget to provide their last name, middle initial, and first name.

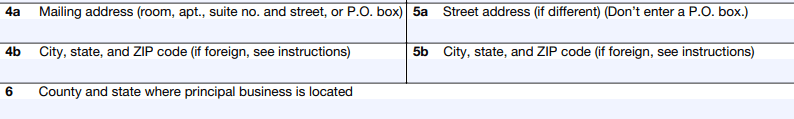

Step 4: Enter The Mailing and Street Address

Giving the correct physical and mailing address for your LLC is essential if you want to receive critical IRS letters. Enter the address where official correspondence is to be sent when filling out the postal address. Give the whole address, without any acronyms, if your LLC is headquartered outside of the United States. Please include the care-of address if you have one.

Only enter the physical address if it is different from the mailing address. Note that physical addresses are not allowed at P.O. boxes. Make sure both addresses are correct and readable to prevent Form SS-4 processing delays.

Step 5: Enter The Responsible Party’s Name

For your EIN application, it is essential that you accurately designate the responsible party. As required, give their full legal name and matching taxpayer identification number (SSN, ITIN, or EIN). Remember that you should leave line 7b blank if the responsible person is not qualified for an SSN or ITIN.

Step 6: Enter Every Detail About Your LLC

It is important that you accurately describe your LLC on Form SS-4. Clarifying your entity's legal structure is crucial for LLCs that are owned by foreign nationals. Note that for federal tax purposes, an LLC may be recognized as a corporation, partnership, or disregarded entity. The quantity of LLC members is also noteworthy.

In a state where community property applies, a single-member LLC may be considered a disregarded entity. To ensure that you are providing accurate information on the ownership and structure of your LLC, carefully review lines 8a and 8b.

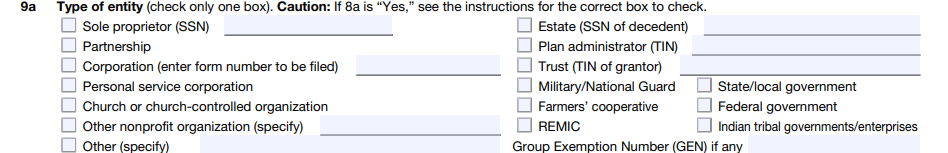

Step 7: Give Input On What Type of Entity Your LLC Is

When filling out Form SS-4, it's important to determine the structure of your LLC. For taxation purposes, the IRS classifies entities in many ways. A corporation, partnership, sole proprietorship, or nonprofit entity, for example, will need particular data and boxes to be checked.

You may be considered to be a sole proprietor if your LLC is not recognized as an entity apart from its owner. You must indicate on the form whether your LLC is regarded as a corporation (C corporation or S company) for tax reasons.

Furthermore, if your LLC is a nonprofit, describe it in depth (e.g., educational). Making the right category choice after carefully going over these possibilities is crucial to a seamless EIN application procedure.

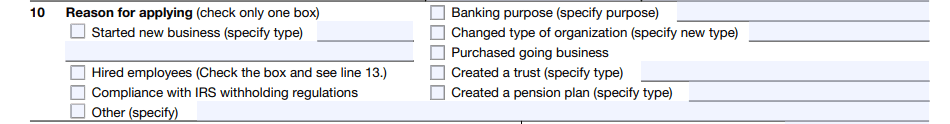

Step 8: Enter Your Reason or Cause Behind The Application

Here are the common reasons for applying:

Launched a new company: Select the type of business by checking this box if you're creating a new LLC.

Hired employees: Briefly specify the reason for your hiring if you have or intend to hire personnel.

Banking purposes: Indicate the reason for the EIN if you require it for banking operations (e.g., investing club, bowling league).

Modified business structure: If your company has undergone modifications, such as going from a sole proprietorship to a partnership, describe them in full.

Acquired an established company: State whether you acquired a running business.

Established a trust: Indicate the kind of trust (split-interest, non-exempt charity, etc.). Take note of the exclusions for specific grantor-type trusts.

Developed a pension plan: Do specify the type of plan if one has been set.

Other: Give a detailed explanation if there is a different reason.

Step 9: Enter Your LLC Starting/Acquisition Date & Your Closing Month of the Current Accounting Year

Enter the commencement date of the LLC if you are creating one. Indicate the date of acquisition if you have purchased an already-existing company. This is the start of your US business for international businesses. The year that you choose for your accounting is also crucial. Most people make use of the calendar year.

However, there are regulations exclusive to corporations, trusts, and partnerships. Partnerships are able to select from a number of choices, but corporations and trusts, unless there are special circumstances, usually use the calendar year. Knowing these rules well will ensure that the information you enter on lines 11 and 12 of Form SS-4 is accurate.

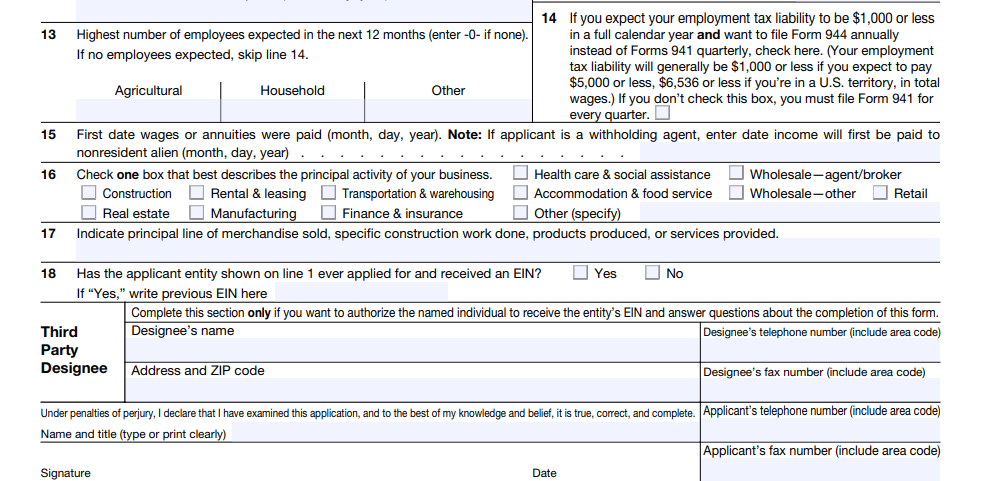

Step 10: Filling Other Criteria (Line 13 — Line 18 & Third-Party Disagree)

You must provide details about your business operations in the next part of Form SS-4. Your anticipated workforce size is requested in Line 13, and this information is essential for figuring up your tax filing obligations. You must also provide the commencement date of wage payments on Line 15 if you plan to hire employees.

It's critical to describe your company accurately. In Line 16, choose the closest category from the list of alternatives, and on Line 17, give a thorough justification of your main business activity. If you work in real estate, for example, be sure to indicate whether you deal with residential, commercial, or other sorts of property.

Lastly, on Line 18, state if your LLC has ever received an EIN before. If you decide to give the EIN to a third party, fill out the appropriate box with that person's contact details. Before sending the form to the IRS, don't forget to sign and date it.

Step 11: Send The Application

It's time to submit Form SS-4 after you've finished it carefully. You can contact us by phone, mail, or fax, among other means. Applying over the phone is the fastest way; mailing or faxing may take several days or weeks to receive a response.

Remember that each responsible party may only use one EIN each day. It is important to remember that you have the option to apply online if you currently have an ITIN or EIN.

Need Help for Form SS-4 and Get EIN for your foreign-owned USA LLC? Call SamsCashFlow Agency

Finding it difficult to complete Form SS-4, and get an EIN for foreign-owned LLC? Have an appointment right now to see the impact SamsCashFlow can have. Click on the link below to book an appointment!

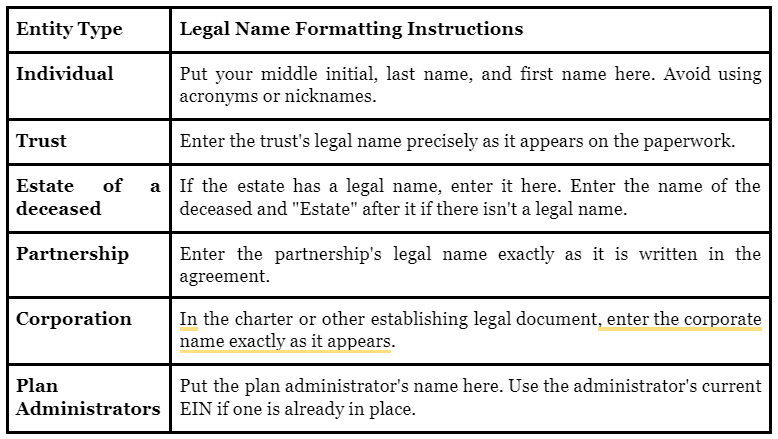

Appendix:

The data below showcases the following:

Entity Type ; Legal Name Formatting Instructions

Individual ; Put your middle initial, last name, and first name here. Avoid using acronyms or nicknames.

Trust ; Enter the trust's legal name precisely as it appears on the paperwork.

Estate of a deceased ; If the estate has a legal name, enter it here. Enter the name of the deceased and "Estate" after it if there isn't a legal name.

Partnership ; Enter the partnership's legal name exactly as it is written in the agreement.

Corporation ; In the charter or other establishing legal document, enter the corporate name exactly as it appears.

Plan Administrators ; Put the plan administrator's name here. Use the administrator's current EIN if one is already in place.