What International Ecommerce Entrepreneurs Need to Know About Launching a Business in the US

A goldmine just waiting to be discovered is the US e-commerce market. It is anticipated to reach a startling $1.9 trillion by 2029, providing enormous opportunity for global businesspeople. So make sure your online business takes off smoothly by familiarizing yourself with the nuances of US tax and accounting regulations related to e-commerce before you debut.

Based on tax brackets, this information will serve as your road map, helping you choose the best business structure and ensuring a smooth, legally compliant launch. Setting these rules as a top priority will help you to successfully negotiate the fascinating world of American e-commerce and carve out a name for yourself in this booming industry.

Step 1. Get a License and Permit!

Starting a US e-commerce venture can be extremely exciting. However, getting the right licenses and permits is an essential step to guarantee smooth sailing before you get carried away.

You might be surprised to learn that many business owners forget this crucial information. Operating without the required permits can result in expensive fines, the confiscation of products, and wasted time resolving legal disputes.

The good news? License specifications tend to match with those of conventional brick-and-mortar establishments. A unique business license is probably not required for everyday products like apparel, electronics, or handcrafted things.

However, state-specific licenses become necessary for products in highly regulated industries like healthcare or medical devices. Avoid a costly detour by contacting your local licensing department and ensuring you have the green light before launch.

Step 2. Understand The Basics of Tax Management In The US

It is fun to begin an e-commerce company in the United States; however, your understanding determines the extent of your accounting and taxation remit. The concept of the sales tax nexus is significant in defining the circumstances under which a merchant in a specific state has to collect and pay the sales tax.

This connection may be caused by operating out of several sites or having sizable sales in a state, necessitating precise tax collection.

Optimizing tax deductions is also crucial. Determining what constitutes an allowable expense—such as office supplies, staff pay, and advertising—lowers taxable income and, consequently, overall tax obligations.

Lastly, year-round compliance and avoidance of fines are guaranteed by predicted tax payments based on projected profits. International e-commerce entrepreneurs can confidently traverse the US tax landscape by proactively controlling these aspects.

→ Overview of Ecommerce Sales Taxes In The USA

Thinking of starting an online store in the US? It's important to understand sales tax. Here's a simplified overview:

Non-US Residents: Until you surpass an annual threshold (usually 200 transactions or $100,000 in sales), you are typically exempt from sales tax registration. Once exceeded, you create an "economic nexus" and are responsible for tax collection and remittance within the United States.

Remember that this is a simplified picture. It is strongly advised that you thoroughly study state regulations before beginning your US e-commerce venture.

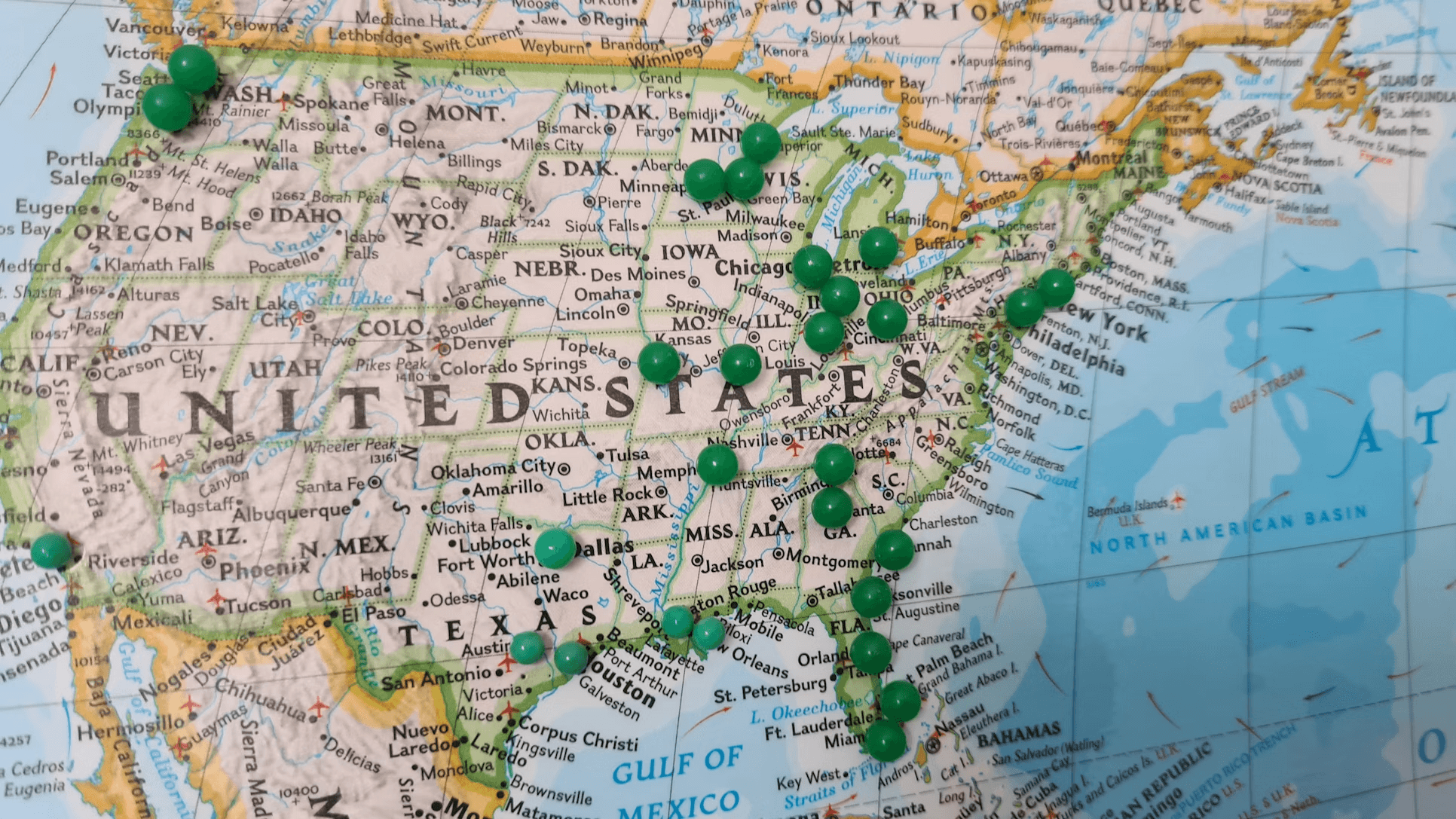

A Glimpse Into Ecommerce Sales Tax In US States

Don't let the complexity of US sales tax stop you from realizing your e-commerce vision. Here is a brief how-to:

Thresholds Rule: Unless an exception applies, most states only collect sales tax when a certain amount is exceeded, usually $100,000 in yearly sales or 200 transactions.

Giants Get Examined: The $500k threshold in Texas, California, Massachusetts, and New York exempts you from collecting taxes.

Sales Tax Above $100K: No matter the number of transactions, if your eCommerce business generates more than $100k gross a year in states like Tennessee, North Dakota, Iowa, and Idaho, you will be liable to pay sales tax.

Beware the Low Bar: Oklahoma and Kansas are two states that have very low thresholds or demand tax collection from the beginning. In Oklahoma, the economic nexus threshold is only $10,000.

State-Specific Oddities:

New York: There is a tax credit available to smaller sellers that transact 100 times a year and earn less than $500,000. Also, under $110 worth of apparel and shoes are free from the tax collector's grip.

California: With the largest state sales tax (7.25%), this state exempts digital products but has the option to impose additional district taxes.

Alabama: Alabama has a $250,000 nexus threshold, and it taxes purchases made by its residents, irrespective of the seller’s physical location.

Texas: The items that the buyer purchases from another state are exempted from taxes. In contrast, the items bought in Texas may attract taxes such as local, state or federal taxes based on the location of the buyer.

Mississippi: If your annual sales exceed $250,000, digital products become taxable.

Remember that this is merely a sneak peek! To guarantee total compliance, always seek advice from qualified tax advisors.

Step 3. Choose The Right Ecommerce Business Structure Based On US Tax Slabs

A critical step for foreign businesses entering the US e-commerce market is choosing the appropriate business structure. This choice influences your tax obligations and daily operations. Gaining knowledge of the various structures and how they correspond with US tax slabs enables you to maximize your financial position.

In the United States, partnerships, limited liability companies (LLCs), C corporations, and sole proprietorships are popular forms of organization for e-commerce enterprises. However, each provides a different tax treatment:

Partnerships And Sole Proprietorships: These are the simplest business structures that ‘flow through’ a business’s gains and losses to the owner’s tax returns. So, in a lower tax bracket, paying taxes at your individual income tax rate is better.

LLCs: Besides, the liability of the members of an LLC is limited, so the corporate debts cannot be paid through personal assets. They can be taxed under S Corporations, but they also offer ‘pass through’ taxes, almost similar to sole traders.

C Corporations: C Corporations are distinct legal entities that pay taxes on their revenues before paying dividends to their stockholders out of any leftover funds. Despite the potential for "double taxation," C Corporations can benefit from tax savings via long-term growth tactics and deductions.

So, carefully analyze your future growth ambitions, risk tolerance, and predicted income when selecting the best structure. Getting advice from a tax expert will ensure you make the most of the US tax system and steer your e-commerce company toward a successful future.

Step 4. Learn About Compliance Strategies To Avoid Any Problem Later

International business owners have a plethora of chances in the US e-commerce sector. However, handling its legal and regulatory framework can be challenging. To build a safe and prosperous company, it is essential to comprehend and apply compliance tactics.

Proper financial management is essential. This entails creating reliable accounting and tax administration procedures and ensuring that all legal requirements are met.

Creating thorough record retention procedures ensures that financial records comply with legal requirements. Internal control implementation also protects against fraud and illegal access to private data.

E-commerce companies reduce the risks of mistakes and fraud by dividing up work and checking transactions frequently. Regular external or internal audits are crucial to determine whether accounting rules and regulations are being followed.

Early detection of possible problems enables quick correction, ensuring a smooth operation and building stakeholder confidence.

→ Overview of US PCI Compliance For Ecommerce Businesses

Getting started with US e-commerce? It is vital to fully understand PCI compliance. The PCI Security Council was established with strict guidelines to protect consumer financial data and was founded by major players in the industry, including Visa and Mastercard.

Compliance extends beyond safe checkout procedures. It provides complete protection for all online transactions, including the transfer and storage of consumer data.

To gain the trust of US customers, e-commerce companies that are frequently subject to data breaches need to give PCI compliance first priority. Best part? The majority of SaaS-based online retailers are already PCI compliant.

Step 5. Creating a Financial Framework: From Opening Business Accounts To Handling Initial Accounting

When you're prepared to launch your foreign e-commerce business in the US, you must ensure your finances are in order. The establishment of a strong framework is crucial. This is your pre-launch checklist:

Banking Base: To keep personal and business finances separate, use specialized US business bank accounts.

Secured Tax ID: Ask the IRS for an Employer Identification Number (EIN). This serves as your company's social security number.

IRS Documents: Knowing and completing the necessary IRS forms is essential for compliance and tax filing.

Be Accounts-Ready: To expedite early bookkeeping and financial reporting, look into accounting software or think about working with a US-based accounting and tax firm.

If you follow these measures, you'll be ready to handle the financial scene and ensure a successful US debut. Remember that this is just the start; to keep your dream of global e-commerce alive, study resources and expert advice.

Unlock The True Potential of The US Ecommerce Market Effortlessly With Samscashflow Agency

To protect your company and clients, implement strong financial procedures and PCI compliance. With this understanding, you'll be ready to take on the thrilling world of US e-commerce and make your foreign business endeavor a huge success.

Believe you can make a fortune in US e-commerce? Avoid diving in without a plan. One important thing to prioritize is financial clarity. It’s crucial to get a clear picture of your profit margins over time.

Need help with that? Book a call with Samscashflow agency today.