How to Open an LLC In The United States As a Non-US Resident

According to IRS statistics, the number of LLCs has increased yearly since 2004. It is a preferred business entity for various reasons, including tax advantages and liability protection. Even foreigners considering starting an entrepreneurial venture in the US choose this structure. However, creating an LLC can be intimidating and complex for non-US residents. Dive into this article to discover the detailed steps for establishing an LLC in the US for foreigners.

Step 1: Pick the Best State

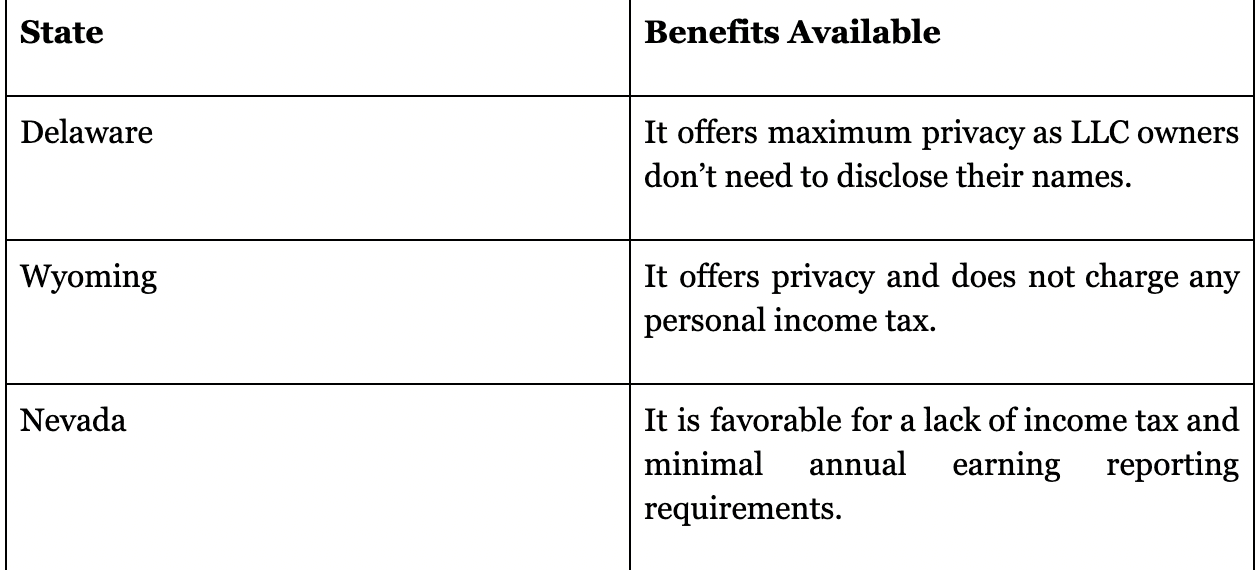

The first thing to decide is the right state in the US for your LLC. Remember that every region is not accommodating and tax-efficient enough for your operations. Some of the best states for foreign professionals to set up an LLC in the US are as follows:

Step 2: Appoint a Registered Agent

While establishing a registered agent is crucial for any limited liability company, the precise requirements vary somewhat between states. You'll need an address and contact within the jurisdiction where formation takes place to accept important paperwork and notices on the LLC's behalf. This representative serves as the public face for all official business and communications.

The registered agent does not have to be of US origin mandatorily. However, having a physical location where documents can be received has emerged as an almost universal standard. This registered address will be used for all official correspondences related to your business.

Rather than tackling these logistics themselves, many entrepreneurs - especially those running multi-state ventures or operating remotely - opt to outsource registered agent responsibilities. Professional registered agent services agree to house necessary records and forward time-sensitive materials to leadership. This proven solution eliminates any question of compliance for founders lacking a base of operations within the United States.

Step 3: Think of a Name

Select a distinguishing name for your limited liability company. Confirm it adheres to the naming standards of the territory you've chosen. You must usually incorporate "LLC" or "Limited Liability Company" in the label.

Step 4: File Articles of Organization

Formulate and submit the Articles of Organization with the Secretary of State in your opted territory. This archive officially establishes your LLC once you provide details like your LLC's name, address, and your company's goal.

Nonresident aliens (NRAs) can usually lodge this independently or seek assistance from various sources, such as attorneys and business formation companies.

Step 5: Get an Operating Agreement

Even though it's not always a legal requirement, drafting an operating contract is strongly recommended. This internal record outlines your LLC's possession structure and functional rules, helping to shelter your company interests. The agreement also determines the decision-making powers and profit allocations between members.

Step 6: Secure Your EIN

Get an EIN from the IRS, even if you aren't considering hiring employees immediately. This singular identifier is fundamental for tax uses and banking dealings. An EIN is also required to open business banking accounts.

You will come across two ways of applying for EIN.

With ITIN or SSN: Use either to apply online for your EIN from the IRS. You can get your EIN within minutes of completing the application. But remember to provide accurate information.

Without ITIN or SSN: If you don't have either, you must complete the SS-4 form. Next, mail or fax it to the IRS. After submission, receiving the EIN takes around 8 to 11 weeks. This timeline can vary depending on the IRS's processing speed.

Step 7: Learn About Compliance

Your LLC should obtain the necessary business permits and licenses for seamless operations. Moreover, it is mandatory to comply with the tax regimens. Apart from IRS compliance, LLCs must determine local and state requirements.

As a nonresident LLC founder, you should learn about the tax implications that come with this business entity:

By default, your LLC is not treated as a separate taxable entity. However, as an owner, you must file Form 1040-NR annually and declare any profits from the LLC.

The US tax code declares a 30% withholding tax on nonresidents who receive certain types of passive US-sourced income, such as interest or rent.

Nonresidents typically pay tax on income "effectively connected" to a business or trade in the US. It can include any gains from selling real property, generally treated as effectively connected income, and it comes with potential capital gains tax obligations.

Some LLCs may require extra reporting due to additional IRS rules applying to those with at least one foreign owner owning 25% or more.

Considering these various LLC tax implications from the start can save nonresident founders significant hassle and costs.

Step 8: Open a US Bank Account for Your Business

Registering your LLC allows you to lawfully operate your company in America. Now is the time to formally divide your commercial endeavors from private funds by creating a business bank account. While establishing this account as an overseas entrepreneur may initially present difficulties, it becomes easier with the EIN.

Separating the monetary movements of your enterprise from your individual spending streamlines management and accountability. This financial partitioning permits effortless compliance with tax legislation and greater visibility into your organization's liquidity, liabilities, and profitability over time.

Need help setting up LLC as a Non-US Resident? Call SamsCashFlow Agency

Want to set up an LLC in the US anytime soon? You will need professional help and that’s where we can help. Click on this now https://www.samscashflow.com/#book!

Appendix

State, Benefits Available

Delaware; It offers maximum privacy as LLC owners don’t need to disclose their names.

Wyoming; It offers privacy and does not charge any personal income tax.

Nevada; It is favorable for a lack of income tax and minimal annual earning reporting requirements.