How to Open a US Bank Account for Non-Residents (Without having to Travel & VISA)

The banking sector in the US reached a valuation of $1.4 trillion in 2023. This shows the importance of using bank accounts for financial purposes. But banking in the United States is no longer as straightforward as it once was.

The USA Patriot Act was put into place to deter using the financial system for nefarious deeds. While far-reaching, a major alteration brought about was more stringent customer verification needs. You may be pondering, "Can a non-citizen open a bank account in America?" Indeed, they can, though the process may be somewhat complex for those who are not citizens.

Whether for enterprise, tourism, or private motivations, establishing an American bank account is worth any frustrations. Banking in the US possesses many benefits. To start, costs tied to cards and the bank are avoided when money is spent within the nation's borders. Even as a non-resident, deposits up to $250,000 are guarded by the Federal Deposit Insurance Corporation.

Continue reading to decode how to create a US bank account as a non-resident without travelling and a visa.

Step 1: Understanding Your Needs

Prior to embarking on the application process, it is imperative to pinpoint precisely why you need a United States banking account. Here are a few reasons:

Commercial dealings: Simplifies handling of payments from American clients or partners.

Investment goals: Facilitates committing capital in United States equities and other fiscal instruments.

Frequent trips across borders: Convenient access to financing while inside the borders of the United States.

Savings: Capitalizing on beneficial interest rates.

Determine the attributes you require, such as online access, negligible charges, or high yields on deposits.

Step 2: Choosing the Right Bank

Not all US banks allow non-residents to open accounts remotely. Research banks that offer this service, focusing on:

Small Banks

Many small financial institutions solely permit individuals from the United States and those who hold permanent residency to establish bank accounts. These institutions mandate a social security number, a document that foreigners do not possess. This obstacle is frequently witnessed by those from other countries.

Fortunately, contemporary banking applications exist that understand the challenges non-natives face when banking in the US. As a result, they authorize the creation of an account without requiring a Social Security Number or an Individual Taxpayer Identification Number. No inquiry into your credit history is conducted; simply present your foreign government identification, and you are all set to proceed.

Large Banks

Many individuals believe that large financial institutions are not an option for those who do not live in the country. However, some major financial institutions like US Bank, Chase, and Wells Fargo permit non-residents to create an account. Instead of your SSN, they will ask for an Individual Taxpayer Identification Number (ITIN). Assuming that the essential criteria are fulfilled, you will have the opportunity to set up an account with these financial institutions.

As a non-resident, you have the option to request a personal account. Current and deposit accounts are examples of personal accounts. Given that opening a conventional bank account can prove to be difficult for non-residents, you may explore other alternatives, like a multi-currency account, an international account, and a correspondent account. These substitute options may facilitate the process of setting up an account from your country of origin.

Correspondence Accounts

They simplify banking for you in regions where your local bank is not physically present. A bank in your home country has a collaborating bank in the United States. Your bank can help you open an account in the US. Even if your home bank does not have a physical branch in the US, they can still provide assistance to you.

Once the account is established, you can conduct wire transfers, make deposits, and engage in other financial activities. These global transactions will be facilitated through a system known as SWIFT, which stands for Society for Worldwide Interbank Financial Telecommunication. A receiving bank will require the SWIFT code of the correspondent bank in order to execute transactions with the overseas bank.

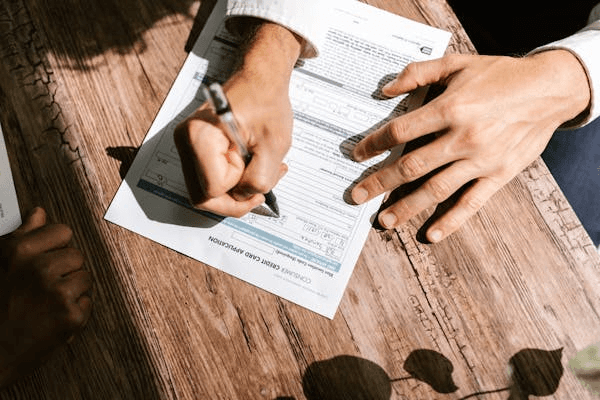

Step 3: Gathering Required Documents

The list of paperwork needed may differ depending on the financial institution. However, typically, you will require the following:

Verification of Identity: Passport, national ID, or driver's license.

Verification of Residence: Utility bills, bank statements, or an official government document.

Taxpayer Identification Number: Certain banks might request an Individual Taxpayer Identification Number (ITIN). If you do not have one, the bank can assist you with the application procedure.

Additional paperwork: Requirements might vary from bank to bank, potentially including a referral letter from your current bank, evidence of earnings, or a detailed business proposal if opening a corporate account.

Step 4: Starting the Application Process

After selecting the financial institution and organizing your paperwork, proceed with the following instructions:

Online Application: Head to the bank's official site and complete the digital application form. Verify that all details are correct and thorough.

Document Submission: Submit the necessary papers online. Certain banks may need official copies to be notarized.

Video Authentication: Numerous banks mandate a video conference to confirm your identity. Get ready to respond to inquiries and display your documents on screen.

Initial Deposit: A starting payment may be necessary to initiate your account. This is typically achievable through a wire transfer or an existing overseas account.

Step 5: Maintaining Your Account

In order to guarantee seamless functioning, it is important to remember the following suggestions:

Consistently review your account statements and transactions for any inconsistencies.

Stay alert to any charges linked to your account and handle them efficiently to prevent avoidable fees.

Maintain communication with your bank, particularly if you intend to carry out substantial transactions or modifications to your account.

Wish to Open A Bank Account In US as a Non-Resident? Contact Samscashflow Agency

Wondering how to open a bank account for non-residents without VISA or any travels? If you face any trouble, click on the link below https://www.samscashflow.com/#book and call Samscashflow agency for professional assistance.