Step-By-Step Guide On How To Reduce Taxes for Divorce Law Firms in the USA

Introduction

Taxation plays a pivotal role in operating legal practices throughout America. Nevertheless, it can likewise constitute a considerable monetary load. Law firms, similar to all enterprises, have to tackle intricate tax rules while aiming to reduce their tax obligations.

This guide provides an exhaustive outline of tactics divorce law firms can apply to efficiently minimize their levies, ensuring compliance while maximizing financial reserves.

As per the research data, US firms spend a lot more on legal services compared to what other nations do around the world.

Numerous smaller law firms have found that retaining a tax consultant who is well-versed in the detailed assortment of tax deductions and credits has enabled them to significantly lighten their tax burden in a completely legitimate manner. Meanwhile, larger law firms have tended to assign specialized in-house tax directors to continuously explore evolving regulations and loopholes to help shield growing revenues from taxation.

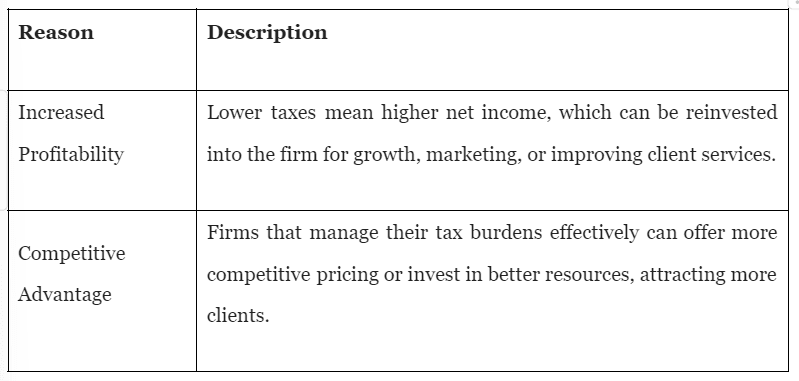

Importance of Tax Reduction for Law Firms

Reducing tax liabilities is crucial for law firms for several reasons:

Steps to Reduce Taxes for Law Firms

Let’s take a look at the steps in which you can successfully cut down on your law firm taxes.

Step 1. Choose the Right Business Structure

The way a law firm is structured—be it sole proprietorship, partnership, LLC, or corporation—greatly impacts how the taxes work. Each kind of entity comes with its own tax outcomes:

Sole Proprietorships and Partnerships: Income is declared on personal tax returns, which can make personal tax rates go higher.

LLCs and LLPs: These can give a liability shield while letting profits move to owners directly, avoiding corporate taxes.

Corporations: Even though they must deal with double taxation (both the corporate level and individual shareholder level), using tactics such as year-end spending can help reduce this financial load.

Step 2. Maximize Deductions

Law firms can take advantage of various deductions to lower taxable income:

Business Expenses: Costs connected to office items, promoting the business, and expert services can be deducted. For instance, half of the expenses for business meals can be deducted if they include conversations with clients.

Travel and Mileage: Costs from traveling for work reasons, like mileage, staying in hotels, and eating meals, can be taken off as expenses.

Retirement Contributions: Money put into employee retirement plans can be subtracted from taxes, giving benefits for tax savings and helping to bring in and retain good workers.

Step 3. Utilize Tax Credits and Incentives

Law firms should look into tax credits available that can lower their taxes directly. For example, hiring certain types of employees or putting money in specific sectors might offer big savings.

Step 4. Implement Effective Accounting Practices

Keeping financial records well-organized is very important for getting the most deductions and staying within the rules. Law firms should buy accounting software that helps them keep an eye on expenses, handle invoices, and get ready for the tax season. Making regular updates to financial statements and doing internal audits can also help find possible deductions and make sure everything is correct.

Step 5. Strategize with Tax Professionals

Working together with a CPA or tax advisor can give a valuable understanding of effective tax plans that fit the firm’s unique situation. These experts can find deductions, credits, and strategies that are unique to how the firm is organized and works. Doing consultations throughout the year, not only in tax season, can help with better planning and saving funds.

Step 6. Consider Year-End Tax Strategies

As the fiscal year closes, law firms can implement strategies to reduce taxable income:

Accelerate Expenses: Think about paying for things ahead of time or buying required equipment before the year ends to have more deductions in that tax year.

Delay Income: If you can, wait to bill clients until next year. This may reduce taxable income for the current year.

Check Depreciation Choices: Use Section 179 of the IRS to subtract the full cost of qualifying equipment and software in the same year you buy them instead of spreading out deductions over many years.

Step 7. Maintain Documentation

Keeping detailed records is very important to prove deductions if there is an audit. Law firms need to document all costs related to the business, including receipts and invoices. They should keep financial documents well-organized for no less than three to seven years.

Things to Keep in Mind

Tax laws frequently change, and staying informed about new regulations or modifications is vital for effective tax planning. Law firms should subscribe to updates from the IRS and tax advisory services to remain compliant and capitalize on new opportunities.

Avoid Common Pitfalls

Many law firms make mistakes that can lead to missed deductions or compliance issues. Common pitfalls include:

Failing to document business expenses adequately.

Mixing personal and business finances.

Ignoring potential deductions related to client-related expenses.

Plan for Audits

Because the IRS closely watches law firms, getting ready for possible audits is very important. Doing internal checks and making sure all papers are correct can reduce worry and problems during a real audit.

Consider Long-Term Tax Planning

Tax reduction should look at not just saving money for the time being but also consider plans for later that match with the company's goals to grow. This involves planning for retirement, making a plan for who will take over the business in the future, and choosing wise investments because these can affect how much tax you have to pay in the coming years.

Utilize Technology

Using technology can make managing finances and preparing taxes much easier. Software designed for practice management, which has tools to track expenses and create reports, helps keep the records organized. This way, you won't miss any deductions when doing your taxes.

Types of Tax Deductions

Here are the main types of tax deductions that law firms can claim to reduce their tax liabilities:

Business Meals

Law firms can deduct 50% of the cost of business meals with clients, partners, and employees if the meals involve discussions related to business. This includes meals for building relationships with clients or partners, as well as daily meals provided to employees during working hours.

Marketing Expenses

Most expenses related to law firm marketing campaigns are tax deductible, such as hiring an SEO agency, building a website, running online ads, printing flyers, or outsourcing marketing tasks to external firms.

Travel Costs

Lawyers can deduct travel expenses incurred while traveling to meet clients or for casework, including airfare, bus/train tickets, hotel stays, meals, and mileage on personal vehicles.

Educational Expenses

Law firms can deduct the cost of educating and training staff. Lawyers can also deduct the cost of continuing legal education (CLE) courses required to maintain their law license.

Home Office

If a lawyer operates their legal business from a dedicated home office space, they can deduct a portion of home expenses like utilities, taxes, insurance, and repairs.

Conclusion

Lowering taxes for divorce law firms in the USA means doing many things, like picking a good business structure, getting the most from deductions, and working with tax experts.

Do you want to minimize your tax liabilities? Are you seeking the best after-tax maximization services? If so, Samscashflow agency is the one-stop solution for all your needs. Contact them right away and ensure lasting success in the legal landscape.