How to Master TikTok Shop Accounting in USA: 7 Key Steps for Influencers

Imagine you’re a beauty brand owner selling makeup on TikTok Shop. Your products are flying off the shelves, your followers are growing rapidly, and you’re finally seeing the fruits of your hard work. But just as your business grows, so do the complexities of managing your finances. Complying with US tax regulations and establishing sound TikTok business accounting practices are indispensable to enjoy a hassle-free experience as a seller on this platform.

In this guide, we detail seven pivotal steps for American influencers to skillfully manage TikTok Shop finances, from partitioning personal and professional accounts to staying current on taxes and tracking inventory levels.

Step 1. Set Up a Separate Business Account

As a beauty brand owner on TikTok Shop, one of your first tasks should be to separate your business and personal finances. This not only helps keep your social media bookkeeping clean but is also critical for tax reporting and business growth.

In the U.S., the IRS requires that business income and expenses be tracked separately from personal influencer finances to prevent confusion at tax time. Here’s why:

Step 2. Track Your Sales Revenue

Accurate revenue tracking is key to understanding your TikTok Shop performance and preparing for taxes. TikTok provides an analytics dashboard that helps you track sales directly on the platform. You can see how many products were sold, total revenue, and even the demographics of your customers. For U.S. influencers, you must track both your gross and net income:

Gross Revenue: This is the total amount you’ve earned before any deductions, such as platform fees or refunds.

Net Revenue: This is the amount left after you deduct transaction fees, refunds, and discounts.

Ensure that you keep detailed records of your sales. You can use e-commerce accounting tools like QuickBooks or Xero to track this automatically or create a custom spreadsheet. Regularly reconciling your sales data with your TikTok Shop dashboard will ensure everything aligns for tax time.

Step 3. Organize Your Business Expenses

Now that you’ve got your revenue covered, it’s time to track your expenses. As a makeup seller, your expenses will likely include inventory costs, shipping fees, platform charges, and marketing efforts.

Here are a few common expenses to keep in mind:

Cost of Goods Sold (COGS): This includes the cost of the makeup you purchase to resell, along with any dropshipping fees.

Marketing: Whether it’s TikTok ads, influencer partnerships, or promotions, marketing is a huge part of growing your beauty brand.

Platform Fees: TikTok takes a commission on each sale (usually 5-10%), which needs to be factored into your profit margin.

Shipping and Fulfillment: Don’t forget the cost of shipping materials or third-party fulfillment services like ShipBob.

In the U.S., the IRS allows you to deduct ordinary and necessary business expenses, which can help reduce your taxable income.

Step 4. Understand Sales Tax Obligations

One of the trickier aspects of TikTok Shop accounting for U.S. influencers is sales tax. In the U.S., each state has its own rules regarding digital sales tax, and the laws can be complex.

Here’s a breakdown of what you need to know:

Consider using an automated tax service like TaxJar or Avalara, which integrates with your sales platform and helps calculate the correct tax rates for each transaction.

Step 5. Monitor Inventory Levels and Costs

As a beauty brand owner, managing your inventory is crucial. If you’re selling makeup, you’ll want to make sure that your products don’t run out of stock or, worse, over-sell. The last thing you want is to disappoint your loyal followers by running out of the latest lipstick shade.

Proper tracking is also important for tax reporting, as inventory costs affect your cost of goods sold (COGS) and, ultimately, your taxable income.

There are two main methods for tracking inventory in the U.S.:

Periodic Inventory Method: This method involves conducting inventory counts at the end of each accounting period (e.g., monthly or quarterly).

Perpetual Inventory Method: This method involves continuously updating inventory levels as you sell or restock products.

Step 6. Pay Yourself and Track Draws

As a beauty brand owner on TikTok Shop, paying yourself is just as important as paying your vendors. How you pay yourself depends on your business structure. For tax purposes, the IRS distinguishes between self-employed individuals (sole proprietors, independent contractors) and business owners (corporations or LLCs).

Here are two common ways influencers can pay themselves:

Step 7. Reconcile Your Accounts Regularly

To ensure the accuracy of your financial records, it’s important to reconcile your business accounts regularly. This process involves matching your business bank account, TikTok Shop revenue reports, and any other financial data to ensure consistency.

In the U.S., frequent reconciliation will help prevent issues during tax season and ensure your financial statements are accurate. You can automate this process with online sales accounting software, which will help you match transactions, flag discrepancies, and create accurate financial reports. Many platforms like QuickBooks, Xero, or even bank-integrated apps offer reconciliation tools.

Searching For The Best Accountancy Firms For Your Tiktok Shop In the USA? Call SamsCashFlow Agency!

Are you overwhelmed to manage the finances of your beauty brand? SamsCashFlow Agency can help. Their expertise in online commerce ensures your financials are handled accurately and on time so you can focus on what matters most—growing your beauty brand. Book a call today: https://www.samscashflow.com/#book.

Appendices:

Appendix 1:

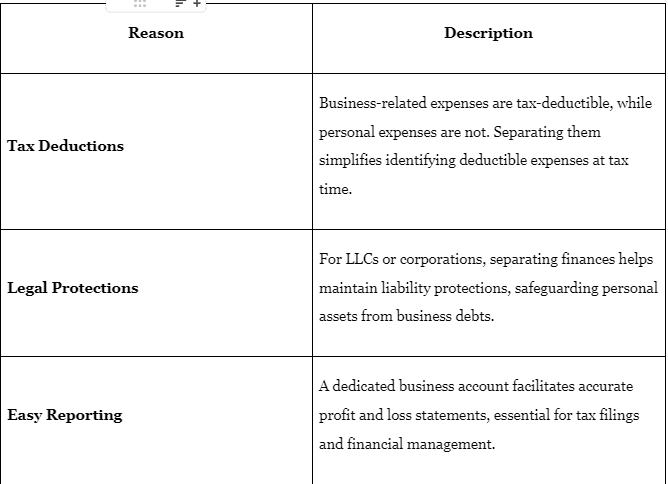

Reasons to Track Professional and Personal Finances Separately, Description

Tax Deductions: Business-related expenses are tax-deductible, while personal expenses are not. Separating them simplifies identifying deductible expenses at tax time.

Legal Protections: For LLCs or corporations, separating finances helps maintain liability protections, safeguarding personal assets from business debts.

Easy Reporting: A dedicated business account facilitates accurate profit and loss statements, essential for tax filings and financial management.

Appendix 2:

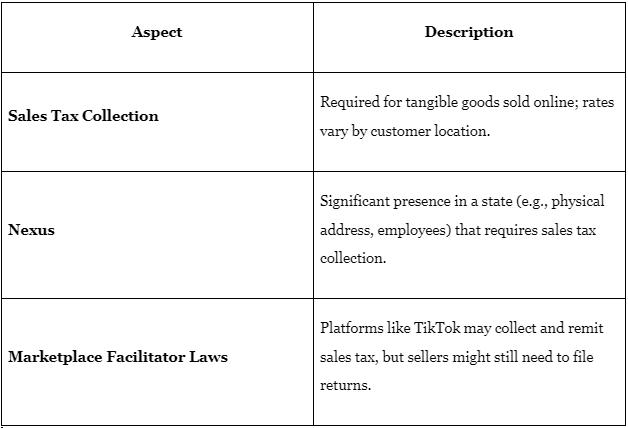

Things To Know About Sales Tax, Description

Sales Tax Collection: Required for tangible goods sold online; rates vary by customer location.

Nexus: Significant presence in a state (e.g., physical address, employees) that requires sales tax collection.

Marketplace Facilitator Laws: Platforms like TikTok may collect and remit sales tax, but sellers might still need to file returns.

Appendix 4:

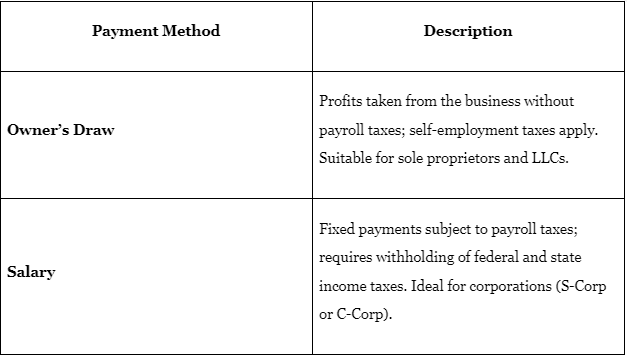

Ways Influencers Can Pay Themselves, Description

Owner’s Draw: Profits taken from the business without payroll taxes; self-employment taxes apply. Suitable for sole proprietors and LLCs.

Salary: Fixed payments subject to payroll taxes; requires withholding of federal and state income taxes. Ideal for corporations (S-Corp or C-Corp).