Proven Strategies for International E-commerce Entrepreneurs Launching a Business in the US

The global ecommerce sector is flourishing, and a projected growth rate of 18.9% between 2024 and 2030 is solid proof of that. For e-commerce entrepreneurs willing to go beyond the geographical boundaries of their own nation, the US marketplace is teeming with potential. Did you know that in 2023 alone, the US e-commerce market pulled in $1065.68 billion in revenues? And it's only going to get bigger at a growth rate of 53.79% between 2024 and 2029.

The promise of enticing opportunities attracts international innovators toward the US e-commerce market, leading to cutthroat competition. Housing approximately 14 million online shopping sites, the US contains 53% of all websites globally. So, an international e-commerce entrepreneur looking forward to setting up their venture in the nation has to work hard to carve out a successful niche in the burgeoning market.

That requires mastering the nuances of the US accounting and tax laws. While it may seem daunting, remember Einstein’s words on how opportunity lies amidst difficulty. Even though decoding the legal and fiscal complexities of the ecommerce sector may seem overwhelming, the reward reaped, in the end, will make the efforts worthwhile.

Becoming familiar with the accounting and tax laws in the US transcends beyond mere necessity to a pathway to transforming potential obstacles into stepping stones for success. So, are you ready to dive in and discover the strategies that will set your e-commerce venture on the path to prosperity? If so, let's get started.

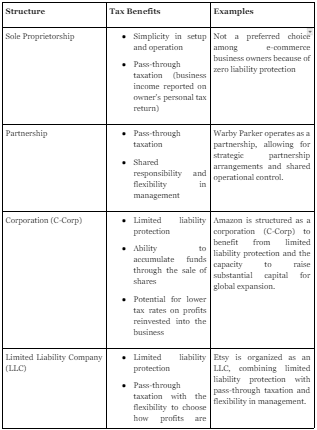

Step 1: Choosing the Right Business Structure for Streamlining Tax Obligations

Picking the appropriate business structure is vital for overseas online business owners starting out in the United States. Every category provides unique benefits in relation to tax advantages, security from liabilities, and flexibility in operations. Below is an in-depth examination of the tax perks linked with each arrangement, along with examples of well-known online commerce companies in the United States that follow the various legal structures of entrepreneurial operations:

Step 2: Embracing US GAAP for Growth and Compliance

For global online business owners venturing into the US market, adopting Generally Accepted Accounting Principles (GAAP) goes beyond just a legal necessity—it serves as a strategic benefit. US GAAP offers a standardized structure for financial reporting, guaranteeing uniformity, openness, and comparability. Following these principles can not only boost trust with investors and stakeholders but also promote growth by presenting a precise financial overview.

How US GAAP Guidelines Can Support Your Online Business Flourish

Consider the following advantages of GAAP for global entrepreneurs launching an online business in the US:

Enhanced Financial Clarity: By following US GAAP, your business can generate clear and cohesive financial reports. This transparency helps establish trust with investors, creditors, and clients, which is crucial for securing funding and forming partnerships.

Improved Financial Evaluation: GAAP principles standardize financial reporting, allowing for better assessment of your performance in comparison to competitors. Accurate financial analysis aids in identifying growth prospects and making well-informed strategic choices.

Reduced Financial Mismanagement Risk: GAAP principles incorporate strict criteria for revenue recognition, expense matching, and asset valuation. Adhering to these principles lowers the risk of financial mismanagement and potential legal problems, ensuring your financial reports accurately reflect your business's true condition.

Compliance and Penalty Avoidance: Following US GAAP guarantees adherence to regulatory mandates, minimizing the risk of penalties and legal disputes. It also streamlines audits and regulatory assessments, safeguarding your business from expensive complications.

Appeal to Investors: Investors favor businesses with transparent and dependable financial reporting. By embracing GAAP, your online company will appear more trustworthy and steady, enhancing its appeal to potential investors and venture capitalists.

Case Study: The Consequences of Ignoring GAAP

Lehman Brothers Holdings Inc., formerly a well-known global financial services company, serves as a clear example of the dangers of disregarding GAAP principles. Below are the GAAP violations carried out by the firm:

Deceptive Financial Reports: Lehman Brothers partook in accounting practices that masked the true severity of its financial troubles. One of the main techniques employed was "Repo 105" transactions. These transactions involved temporarily shifting debt off the company's balance sheet to enhance its financial outlook at the end of reporting periods.

Insufficient Disclosures: Lehman Brothers failed to completely reveal the nature and risks linked with its off-balance-sheet operations. This lack of openness was a breach of GAAP rules, which require full and honest disclosure of financial responsibilities and risks.

In September 2008, Lehman Brothers filed for insolvency, marking the largest bankruptcy incident in US history. The company's collapse had significant repercussions on the global financial system, contributing to the broader financial crisis of 2008.

The aftermath of Lehman Brothers' downfall played a crucial role in shaping new financial regulations. Under Obama’s presidency in 2010, the Dodd-Frank Wall Street Reform with the Consumer Protection Act was implemented to boost transparency in financial reporting, enhance risk management, and strengthen regulatory supervision. Although these regulations are still in place, they were diluted to a great extent in 2018 once the Economic Growth, Regulatory Relief, and Consumer Protection Act was passed.

Step 3: Strategies for Tax Optimization

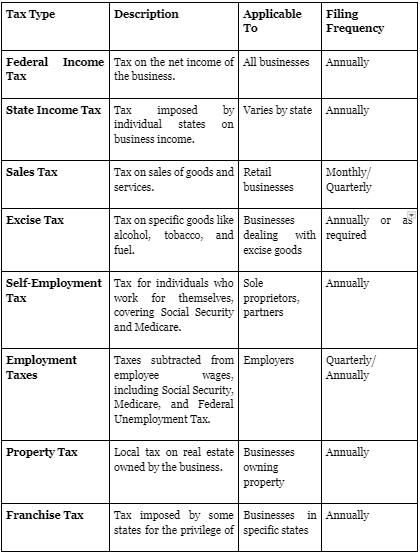

As of May 2024, the income tax revenue in the US stands at $319.490 billion. This data paints a picture of the stringent tax implications of running a business in the US. Here’s a table outlining the types of taxes that international business owners need to be aware of when operating in the US:

Available Tax Benefits

The good news is that there are several provisions in the law that allow e-commerce business owners to claim tax deductions. Take a look at some tax-saving strategy examples below:

Research & Development (R&D) Tax Credit: Online businesses that invest in creating new goods or software can receive benefits from R&D tax refunds. For instance, if an online seller creates a unique stock management system, they can request a refund for a portion of the related expenses.

Work Opportunity Tax Credit: This reward motivates companies to hire individuals from specific groups that have historically encountered significant obstacles in finding work. An online trading platform that employs veterans or people who have been unemployed for a long time could get a refund of up to $2,400 per eligible worker.

Renewable Energy Incentives: By setting up solar panels or using other renewable energy sources in storage facilities, businesses can not only decrease their environmental impact but also make use of tax refunds. For instance, the federal tax credit for solar investment allows for a reduction of 26% of the expenses of setting up a solar power system.

Double Tax Agreements: The United States has agreements with numerous nations to avoid taxing international companies twice on their earnings. For instance, the United States-United Kingdom tax agreement assists corporations such as Unilever in preventing double taxation on their international revenue, increasing their profits.

State-Specific Incentives: Various regions provide extra deductions customized to local goals. An online business established in California might take advantage of the California Competes Tax Refund, which is designed for companies that generate job opportunities in the region.

Case Study: Following the Tax-Saving Initiatives of Amazon

Amazon's tax breaks primarily stem from three key factors:

Investment in Research & Development: Amazon places a significant focus on research and development, leading to tax benefits. In the year 2023, Amazon spent a total of $85.622 billion on research and development.

Investment in Property, Plant, and Equipment: Amazon's investments in property, plant, and equipment also qualify for tax credits. Cities can reap the benefits of Amazon's investments in real estate and job creation. Amazon spent $204.177 billion on PPE in 2023.

Credits for Green Efforts: Amazon has portrayed its focus on sustainability by maintaining its position as the largest purchaser of renewable power sources in the corporate sector for four years in a row. This makes the company eligible for the Investment Tax Credit (ITC) and the Federal Production Tax Credit (PTC).

Amazon upholds several concrete tax benefits for international entrepreneurs launching their e-commerce business in the US.

Get In Touch With SamsCashFlow Agency

Need Help? Wish to get the best advice for effective tax strategies? Book a call today with professional accountants and bookkeeping experts like SamsCashFlow, who can help ecommerce entrepreneurs in accounting, bookkeeping, as well as after-tax maximization.

Appendix -

Table 1:

Sole Proprietorship

Tax Benefits; Simplicity in setup and operation; Pass-through taxation, meaning business income is reported on the owner's personal tax return.

Examples - Not a preferred choice among e-commerce business owners due to zero liability protection.

Partnership

Tax Benefits; Pass-through taxation, where income is reported on partners' personal tax returns; Shared responsibility and flexibility in management.

Examples - Warby Parker operates as a partnership, allowing for strategic partnership arrangements and shared operational control.

Corporation (C-Corp)

Tax Benefits; Provides limited liability protection for its shareholders; Ability to accumulate funds through the sale of shares; Potential for lower tax rates on profits that are reinvested into the business.

Examples - Amazon is structured as a corporation (C-Corp) to benefit from limited liability protection and the capacity to raise substantial capital for global expansion.

Limited Liability Company (LLC)

Tax Benefits; Offers limited liability protection to its members; Pass-through taxation with the flexibility to choose how profits are taxed.

Examples - Etsy is organized as an LLC, combining limited liability protection with pass-through taxation and flexibility in management.

Table 2:

Federal Income Tax

Description: Tax on the net income of the business; Applicable To: All businesses; Filing Frequency: Annually

State Income Tax

Description: Tax imposed by individual states on business income; Applicable To: Varies by state

Filing Frequency; Annually

Sales Tax

Description: Tax on sales of goods and services.

Applicable To; Retail businesses

Filing Frequency; Monthly/Quarterly

Excise Tax

Description; Tax on specific goods like alcohol, tobacco, and fuel.

Applicable To; Businesses dealing with excise goods

Filing Frequency; Annually or as required

Self-Employment Tax

Description: Tax for individuals who work for themselves, covering Social Security and Medicare.

Applicable To; Sole proprietors, partners

Filing Frequency; Annually

Employment Taxes

Description; Taxes subtracted from employee wages, including Social Security, Medicare, and Federal Unemployment Tax.

Applicable To; Employers

Filing Frequency; Quarterly/Annually

Property Tax

Description; Local tax on real estate owned by the business.

Applicable To; Businesses owning property

Filing Frequency; Annually

Franchise Tax

Description; Tax imposed by some states for the privilege of doing business in that state.

Applicable To; Businesses in specific states

Filing Frequency; Annually

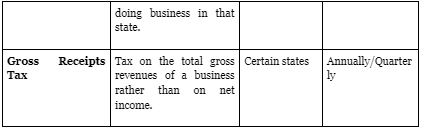

Gross Receipts Tax

Description; Tax on the total gross revenues of a business rather than on net income.

Applicable To; Certain states

Filing Frequency; Annually/Quarterly